Rethinking Philanthropy: How Business Leaders Can Help Nonprofits Create Lasting Impact

Rethinking philanthropy through a business lens. Nonprofits, government, and business leaders can collaborate to create lasting impact and economic mobility.

Rethinking philanthropy through a business lens. Nonprofits, government, and business leaders can collaborate to create lasting impact and economic mobility.

Learn how to report net assets accurately on your nonprofit’s financial statements. Understand GAAP rules, donor restrictions, and required disclosures.

In the latest episode of A Modern Nonprofit podcast, host Tosha Anderson sat down with Sawyer Nyquist, a data expert who specializes in analytics and data management for nonprofits. Their conversation explored the strategic role of data in the nonprofit sector and how organizations can leverage it to achieve their goals more effectively.

Tasha kicked off the discussion by highlighting a common issue in the nonprofit world: many organizations have an abundance of data but struggle to make sense of it or convert it into meaningful stories of impact. Sawyer agreed, noting that while there was once a push to collect as much data as possible, organizations now need to be more intentional about their data practices.

“Data by itself isn’t valuable,” Sawyer explained. “Data that is purposeful and thoughtful and designed with intention can be extremely valuable for an organization.”

See the full video here via Youtube:

The conversation touched on the evolution of data use in nonprofits. Sawyer shared an example of a camping organization that used data to optimize their bus deployment, saving staff time and reducing maintenance costs. This illustrates how data can serve a decision-making function within an organization.

Sawyer introduced the concept of “decision-driven data” – figuring out what decisions need to be made, then determining what data will provide the necessary context for more informed choices.

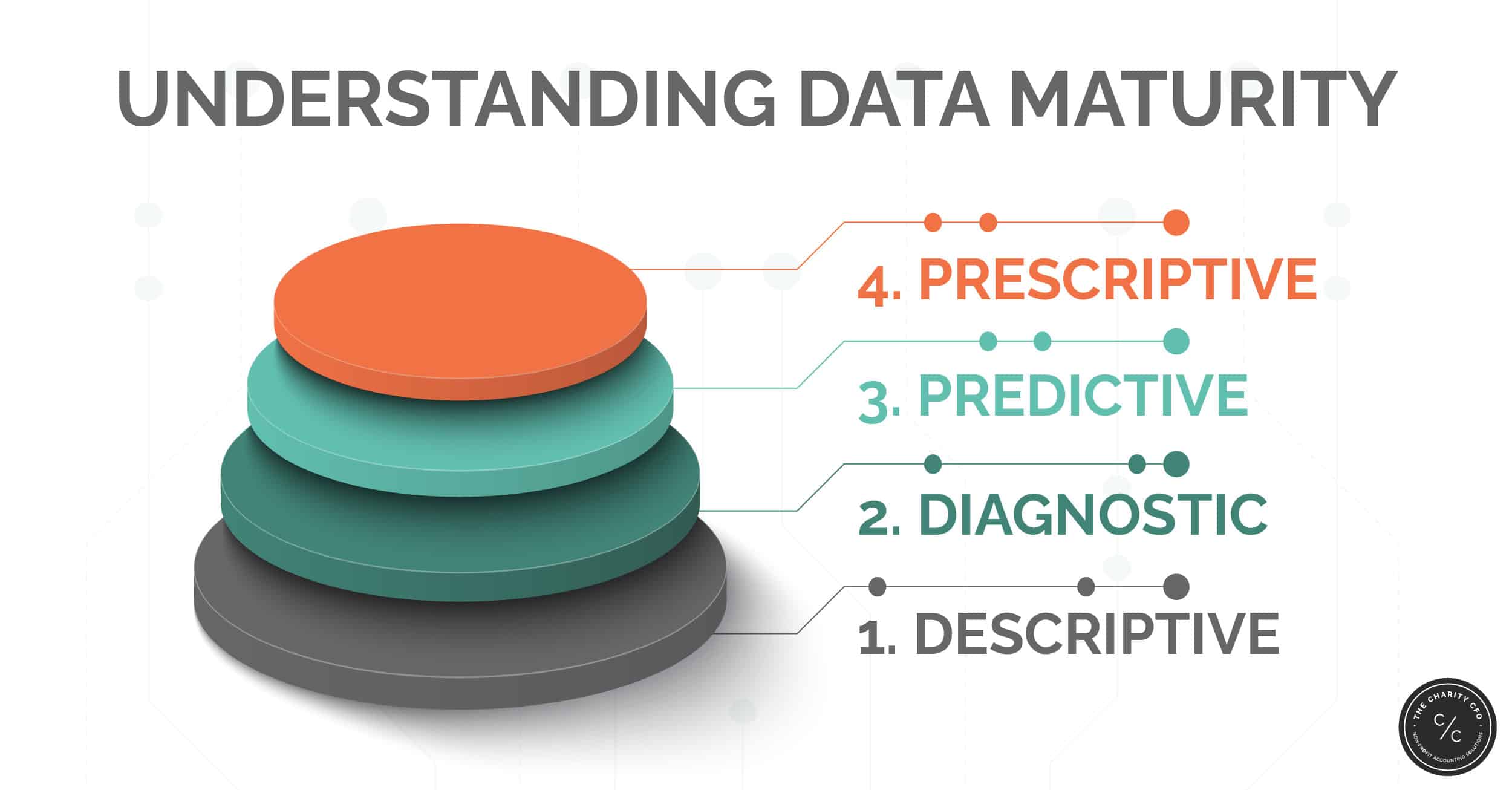

Sawyer outlined a four-level scale of data maturity:

He emphasized that organizations can’t jump straight to the highest level – it’s a process of building foundations and developing both technological capabilities and data literacy within the organization.

When it comes to deciding what to measure, Sawyer cautioned against tracking too much. He suggested focusing on:

Tasha agreed, stressing the importance of customizing metrics to each organization’s unique mission and operational context.

Sawyer shared two case studies of how organizations have used data to improve their operations:

These examples demonstrate how data can both increase operational efficiency and directly support an organization’s core mission.

Sawyer walked through what the data journey typically looks like for nonprofits of different sizes:

Tasha noted that many nonprofits feel overwhelmed by their data and don’t know where to start. Sawyer’s work helps bridge this gap, assisting organizations in connecting their mission to measurable outcomes and making better decisions along the way.

He emphasized the importance of data in nonprofit work, stating, “Their mission is too important to ignore data and to waste their data.”

As nonprofits continue to face pressure to demonstrate their impact, embracing data-driven decision-making becomes increasingly crucial. By understanding the strategic role of data and taking steps to mature their data practices, organizations can enhance their operations, tell more compelling stories, and ultimately make a greater impact in their communities.

Follow Us Online

Stay connected and get more exclusive content on:

Finding the right accounting partner for your nonprofit is essential to the financial success of your nonprofit organization.

Being prepared can help you avoid accounting mistakes that could come up in a nonprofit audit.

It’s obvious that well-run and successful nonprofits need the security and flexibility that operating reserves provide.

Nonprofit organizations must also navigate complex tax laws and regulations to remain compliant. 1099 Best practices will help.

The finance director role is critical to the success of any nonprofit, making it one of the most important hires an organization can make. They are responsible for the financial health of the organization. They create and maintain financial records, prepare financial reports, and oversee the organization’s budget.

Financial managers often work closely with the organization’s executive director to ensure that the organization’s financial needs are met and help drive best financial practices within the organization. They handle all payroll and accounting functions and manage investments and fundraising efforts.

If you are looking for a finance director, it is important to find someone who is not only qualified for the position but also fits well with the organization’s culture. Here’s a look at some of the qualifications you should look for in a nonprofit finance director and tips on how to verify those qualifications:

This is the minimum educational requirement for most nonprofit finance director positions. A bachelor’s degree will give the candidate a strong foundation in accounting and finance principles, which is essential for the role.

They should demonstrate an extensive understanding of accounting and finance regulations and best practices for financial management in a nonprofit setting.

Why this is important

A bachelor’s degree in accounting, finance, or other related fields prepares them to analyze financial data and advise the nonprofit on financial decisions. This background helps them provide oversight for and manage all forecasts, budgets, and investments for the organization.

How to verify

The best way to verify that a candidate has the necessary educational qualifications is to request a certified copy of their transcript from their college or university. If in doubt, you can always contact the school to confirm that the candidate did indeed graduate with the degree they claim to have.

While not always required, certification from one of these professional organizations is highly preferred for finance director positions. These certifications demonstrate that the candidate has the necessary skills and knowledge to perform the job effectively.

CFAs are best known for investment analysis and wealth planning, CPAs for tax preparation and financial statement auditing, and CFPs for financial planning. Working with a CPA with additional certification, such as a CFA or CFP, can bring a well-rounded perspective to the finance director role.

Why this is important

Nonprofits are subject to a unique set of financial rules and regulations. A CPA, CFA, or CFP designation shows that the candidate is familiar with these rules and regulations and is, therefore, better suited to advise the organization on financial matters. CPAs. CFAs and CFPs will provide a more micro analysis of how the organization’s finances and assets are managed and allocated.

How to verify

The best way to verify that a candidate has the necessary certification is to request a copy of their certificate from the issuing organization.

You want to work with someone with extensive industry-specific experience. Look for a nonprofit finance director with at least five years of experience working in accounting, finance, or a related field.

The candidate should be able to show that they have progressively more responsibility in their previous roles, as this will demonstrate their ability to take on more complex tasks.

Why this is important

Work experience ensures the candidate can hit the ground running and be an effective team member from day one. It also allows them to bring their own unique perspective and insights to the role.

How to verify

Candidates should have a clear career progression that shows they have taken on more responsibility over time. This progression should be evident from their resume and/or LinkedIn profile.

This is quite a common requirement, as most organizations will want to see that the candidate has some experience working in the nonprofit sector. This experience is essential for understanding the unique financial challenges that nonprofits face.

Why this is important

The success of a nonprofit organization depends on its ability to deploy its financial resources efficiently. The finance director plays a vital role in ensuring that the nonprofit uses its resources and assets in the most effective way possible.

How to verify

The best way to verify that a candidate has the necessary experience is to request references from previous employers. These references should be able to attest to the candidate’s experience and skills.

Today, technology is at the center of most businesses—and nonprofits are no exception. As nonprofits become increasingly reliant on technology, finance directors must have experience working with and integrating various financial systems and software programs. This experience will be invaluable in ensuring that the organization’s finances are managed effectively and efficiently.

Why this is important

With the right technology in place, nonprofits can save time and money by automating various financial tasks. Expertise in various technology systems also helps improve bookkeeping and accounting productivity, accuracy, and compliance.

How to verify

When reviewing a candidate’s resume, look for evidence of experience working with various financial software programs and systems. You can also ask them specific questions about their experience during the interview process.

A finance director must be able to understand and analyze complex data sets. They should also be comfortable working with spreadsheets and other financial software programs.

Why this is important

Analytical skills are critical for evaluating financial data and making sound decisions about where to allocate resources.

How to verify

Verify by asking the candidate to describe a time when they had to analyze complex data in their previous role. You can also ask them specific questions about their experience working with spreadsheets and financial software programs.

The ability for communication, with various stakeholders, is essential for the finance director role. The candidate should be able to distill complex financial information into layman’s terms and present it in a way that is easy to understand.

Why this is important

The finance director is often the bridge between the accounting/finance department and other departments within the organization. As such, they need to be able to clearly communicate financial information to people with non-financial backgrounds.

How to verify

Communication skills can be difficult to assess, but you can get a good sense of a candidate’s ability by paying attention to how they communicate during the interview process. Do they speak clearly and concisely? Are they able to explain complex concepts in simple terms?

In addition to being an expert in financial matters, the finance director must also be a competent leader and manager. They should have experience leading and motivating teams, as well as experience developing and implementing strategic plans.

Why this is important

The finance director is responsible for leading the organization’s finance team and ensuring it functions effectively. They must also be able to work closely with other department heads to develop and implement strategic plans that achieve the organization’s goals.

How to verify

Do they exhibit high emotional intelligence? Are they able to take charge and motivate a team? Do they have experience leading and managing people? These are all qualities that will be important in a successful finance director.

The finance director should be able to think long-term, anticipate future trends, and develop strategic plans accordingly.

Why this is important

The finance director plays a key role in developing and implementing the organization’s strategic plan. They must be able to anticipate future trends and be able to adjust and execute the plan.

How to verify

Does the finance director have a track record of successfully implementing strategic plans? Do they have a history of being able to anticipate future trends?

If your organization doesn’t have the budget or staffing needs to support a full-time finance director, you may want to consider hiring a part-time or freelance finance consultant. This can be a cost-effective way to get the expertise you need without breaking the bank.

When hiring a part-time or freelance financial consultant, be sure to verify their experience and qualifications just as you would for a full-time finance director. In addition, be sure to clearly define the scope of work and expectations upfront to avoid any misunderstandings down the road.

If your organization is in need of top-notch financial leadership but doesn’t have the budget to support a full-time finance director, outsourcing your accounting and finance functions may help you close the gap and get the expert help you need.

At The Charity CFO, we offer a full range of professional outsourced CFO and accounting services to nonprofits of all sizes. Our team of experienced financial leaders can provide the expertise you need to keep your organization on track without breaking the bank.

Our bespoke services are designed to meet each client’s unique needs and can be customized to include as much or as little support as you need. Whether you need help with financial planning and budgeting, grant management, short and long-term planning, or a team leader who will play a formative role in building the culture, we’re here to help.

Contact us today to learn more about our nonprofit CPA and CFO services and how we can help your organization thrive and succeed in its mission.

No time to read this article now? Download it for later.

Likely to the dismay of many nonprofit leaders, nonprofit organizations must practically live and breathe bureaucracy to maintain their tax-exempt status and ensure the continuation of their mission.

While the Form W-9 for nonprofits is just one more in the constant flow of forms, it has a bright side: it’s fairly straightforward and simple to complete.

It’s also not necessary for every organization or every tax season, so read on to find out if you need to fill it out and, if so, how.

The Form W-9, also called the “Request for Taxpayer Identification Number and Certification” is a form used when your nonprofit needs to provide its taxpayer identification number (TIN) to another requesting organization. As a nonprofit, your TIN is the same as an Employee Identification Number (EIN), which you receive after filing IRS Form SS-4. Although it is the primary piece of information being transferred, the form includes all of the following:

You will need to fill this form if your nonprofit must provide its TIN (and the accompanying information) to another requesting organization that needs to file an information return with the IRS using said number. There are several reasons that an organization may need the TIN of your organization, including the reporting of:

The Form W-9 for nonprofits is typically only necessary if the transaction in question reached a total value of more than $600 over the year. When the requesting organization receives your filled Form W-9, it uses it to file the Form 1099-MISC documenting the total monetary amount paid. Thus, neither organization files the W-9 with the IRS; it is merely a tool for obtaining information in the grander process of tax filing.

Given that the request is legitimate, refusing to provide your TIN via the Form W-9 can result in the requester withholding taxes from your pay at a rate of 24%. In addition, because the requester can face fines if they do not obtain the Form W-9 from you, they will be very motivated to do so.

The form is available on the IRS website. From there, you can either print it to fill out by hand or fill it out digitally.

In Box 1, you must enter the legal name of your nonprofit as registered with the IRS when receiving your EIN/TIN.

If your organization is legally operating under a name that is different from the name in Box 1, otherwise known as a DBA, or doing-business-as, enter that name in Box 2. Otherwise, leave Box 2 empty.

In Box 3, nonprofits should check the box marked “other” and write “Nonprofit corporation exempt under IRS Code Section ___.” Fill in the blank with the code section number for the type of tax exemption your organization has, such as 501(c)(3).

Assuming you are a tax-exempt nonprofit under 501(c), you should leave this box blank.

Box 5 provides a field for the organization’s street number, street name, and interior number.

Box 6 provides space for the entity’s city, state, and zip code.

There is also an unnumbered box for optionally providing the requester’s name and address.

Box 7 provides the option of listing account numbers that your employer might need. However, listing these is optional.

Enter your IRS-issued EIN in Box 8. You cannot be a nonprofit organization without an EIN number, so you should always use the EIN section and leave the Social Security number box empty.

The section labeled “Part II” is for certifying that:

All you need to do in this section is provide your signature and the date.

There’s no need to send the form to the IRS. You simply send it to the entity that requested your W-9, and then your work is done.

The last several pages of the Form W-9 provide ample instructions and explanations about each section to be filled out. If unsure about some detail, check those sections for in-depth information on each requirement. It’s also a good idea to review what you have filled out to check for errors.

Although the Form W-9 is on the simpler side, there can always be unforeseen obstacles requiring assistance. If you’re still unsure about something and feel that you could benefit from personal guidance for your unique situation, consider contacting the Charity CFO. With our expert bookkeeping and accounting support, you can focus more on your nonprofit’s mission while we worry about the paperwork.

You need money to carry out your mission. But how do nonprofits make money anyway? We’ll walk you through 8 popular money-making strategies.

Starting from 2019, all nonprofits must follow ASC 606 rules for revenue recognition. What is ASC 606? And does it apply to you? Find out here!

The psychology of fundraising is a fascinating topic. Why do people donate? What do they want? And how can you raise more? We’ll explore that and more in this article.

Many nonprofit board committees are put in place without much thought or strategy. Learn how to get more from your board committees in this article.

The finance committee plays a critical role in financial oversight, but it doesn’t stop there. Here are some tips to set your organization up for financial success.

Today we’re very proud to announce that Zack Meyer is joining our team in the newly-created role of Director of Quality Assurance.

Zack joins us after two decades as a not-for-profit accountant in both public accounting and the nonprofit industry. In this new role, he will serve as one of our in-house experts on existing and emerging nonprofit accounting standards and auditing best practices.

His primary role will be to lead the organization’s quality control and training programs. In doing so, Zack will help ensure that our clients’ financials are prepared in accordance with general accepted accounting principles (GAAP) and their 990s meet IRS guidelines.

In an ever-evolving world of accounting and tax regulations, Zack will be the primary resource to the Charity CFO team and lead company-wide accounting training and technical updates.

Zack is a CPA and graduate of one of the nation’s top 3 accounting programs at the University of Illinois. And he began his career in public accounting focusing on audits of local and national nonprofit and governmental organizations.

In 2015, Zack moved across the desk and joined the finance team of a $100 million national not-for-profit organization based in Missouri. During his time there, he led the organization’s migration from a 15-year old legacy accounting system to a cloud-based solution, changed its basis of accounting, and implemented their first cloud and app-based expense reporting and time entry systems.

Zack has served as a volunteer and advisor to numerous local nonprofits. He looks forward to continuing to work with nonprofits both in St. Louis and nationwide.

Please join us in welcoming Zack Meyer to The Charity CFO!

We’re proud to announce that Sara Welch has been promoted to the role of Staff Accountant at The Charity CFO.

Sara joined our team as an Accounting Assistant, coming from a background in both healthcare and higher education. She showed an immediate aptitude and passion for accounting, making herself an invaluable part of our client service team.

Sara first explored her passion for helping others by attending Occupational Therapy Assisting school after completing a Bachelor’s of Science in Exercise Science at Southern Illinois University – Edwardsville.

And while helping others was always the main goal, neither healthcare nor higher education seemed an appropriate fit. A chance meeting with The Charity CFO Founder and CEO Tosha Anderson opened Sara’s eyes to the world of nonprofit accounting.

She has excelled at her role and is eager to continue growing within the company.

In her free time, Sara enjoys camping, hiking, and all things outdoors. She also enjoys painting, traveling to new places, and hosting game nights for friends.

Please join us in congratulating Sara on her promotion! There are many ways to help others, and we’re so glad that Sara has chosen to help us support our clients and the valuable work they do in their communities.

We’re very happy to announce that Isabel Sippo has joined our growing team in the role of Onboarding Specialist.

Isabel’s philanthropic passion started at St. Louis University where received a Service Leadership certificate after completing workshops, classes, and over 300 hours of community service.

She gave volunteer accounting assistance to the YWCA and instructed exercise classes to retired priests at Jesuit Hall, all while earning Business Administration degrees in Accounting and International Business!

Isabel then went on to receive her Master’s in Business Administration from Fontbonne University.

After over a decade of accounting experience, including over 4 years of auditing non-profits, school districts, and healthcare facilities, and 5+ years working as the Finance Director of a large non-profit, she is happily transitioning to The Charity CFO as an Onboarding Specialist.

Her experience, experience, knowledge, and appreciation of the nonprofit sector will bring so much value to our clients. Especially since the onboarding process is so critical to their success.

Isabel will work exclusively with our newest clients to both catch up on backlogged bookkeeping needs and clean up any existing accounting issues. At the same time, she’ll help our nonprofit clients implement best practices and processes that optimize their back-office, save them countless hours, and give them the clarity they need to move their mission forward.

In her free time, Isabel values her family time, donates enthusiastically to American Red Cross: Heroes for Babies, volunteers at local charities during the holidays, and finds creative ways to use her hobbies to fundraise for charities dear to heart.

Please join us in welcoming Isabel to our team. Our new clients can rest assured that they’ve got the perfect partner to help them modernize and optimize their accounting department!

We’re proud to announce that Triná Owens has joined The Charity CFO in the role of Accounting Manager!

Triná joins our team after serving in senior finance positions at two different local St. Louis nonprofits. Her knowledge of the nonprofit industry and her first-hand experience navigating the challenges of nonprofit accounting will make her an invaluable asset for our clients.

Triná holds a Master’s Degree in Business Administration and a BA in Accounting from Harris-Stowe State University. She decided early in her career to only serve nonprofits with her skills in accounting and finance, and she honed her talents working for several nonprofits in the St. Louis area.

She is dedicated to furthering her professional growth to better serve the nonprofit community, most recently graduating with the Spring 2020 Emerging Leaders cohort with Focus St. Louis.

When she isn’t working with our nonprofit clients, Triná serves in several volunteer roles, including:

As if that doesn’t keep her busy enough, she was also responsible for her church’s finances and outreach for 10+ years and held small group sessions at small her church teaching congregants how to budget. Most recently, she assisted a class with Eden on creating a budget for churches and other nonprofits.

Please join us in welcoming Triná to our team! We feel fortunate to have her with us…and we know that our clients will feel the same way!

On this week’s episode of A Modern Nonprofit Podcast, CEO Tosha Anderson invites Eric Ressler as her guest. Eric Ressler is the Founder and Creative Director at Cosmic, A Social Impact Creative Agency. Eric Ressler expresses his opinions and expertise about, “The most effective ways to expand visibility and maintain funding in your business.” Why do so many social impact organizations struggle to find, grow, and maintain funding? Eric breaks this question down and gives listeners tips to implement in your own processes. What does the future of social impact fundraising look like? Eric goes into the importance of your digital footprint and doing it in an authentic way. We cover why does social impact organizations invest in their digital strategy and platforms? We also hit on why should social impact organizations concern themselves with their brand when it seems like there are more important things to focus on? Finally why is the overhead percentage the wrong metric for assessing a social impact organization’s effectiveness? This episode is a wonderful conversation and a must listen.

Reach out to Eric Ressler @ [email protected]

Website: designbycosmic.com