Your Budget Isn’t Enough: The Forecasting Advantage for Nonprofits

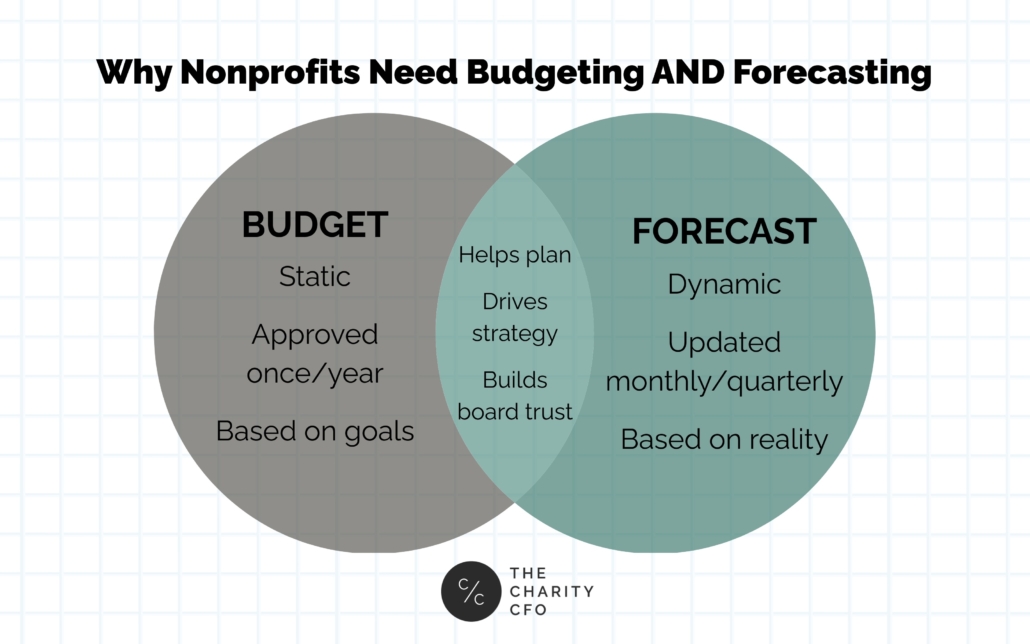

Let’s be real: Budgets are static. Forecasts are strategic.

Most nonprofit leaders excel at building a budget—usually because it’s required by the board or bylaws. But what happens when reality deviates from the plan? In this episode of A Modern Nonprofit Podcast, Tosha Anderson sits down with CPA and nonprofit finance expert David Steffens to explore why forecasting is the critical tool for organizations seeking financial clarity and long-term sustainability.

Why Budgeting Alone Doesn’t Cut It for Nonprofits

Budgets are essential. They reflect your intentions, priorities, and strategic vision. But there’s a problem: the moment your budget is approved, it’s already outdated.

A budget shows where you wanted to go. A forecast shows where you actually are—and where you’re headed. As David Steffens explains, “A forecast is your GPS. It keeps you out of trouble.”

That means forecasting helps you:

- React to cash flow changes

- Adjust for revenue shortfalls or windfalls

- Respond to unexpected program shifts or delays

Forecasting as a Nonprofit’s Financial Early Warning System

Many of the financial challenges that derail nonprofits—unexpected capital expenditures, seasonal fundraising gaps, timing mismatches—aren’t included in the original budget.

Forecasting gives nonprofit leaders a strategic advantage by allowing them to:

- Model different financial scenarios

- Spot risks before they become emergencies

- Make informed decisions in real time

It doesn’t have to be complex. Start with your existing budget. Then, update projections monthly or quarterly. Replace budgeted numbers with actuals and monitor both net income and cash flow impact. The goal? Shift from reactive firefighting to proactive planning.

Budgeting Mistakes Nonprofits Make (And How to Fix Them)

David and Tosha also break down common budgeting missteps they see again and again in nonprofit organizations:

1. Skipping Cross-Team Input

Budgets built in silos—especially without input from the development team—often miss the mark. Revenue targets must be aligned with fundraising capacity.

2. Plugging Numbers to “Make It Work”

Trying to force a break-even budget by padding numbers leads to unrealistic expectations. It’s better to face deficits honestly and plan accordingly.

3. Ignoring Seasonality

Revenue and expenses rarely follow a straight line. Forecasting helps you account for timing differences that could otherwise trigger cash flow crunches.

4. Overlooking One-Time Cash Events

Loan repayments, capital purchases, or delayed grants can all strain cash unexpectedly if not forecasted.

The fix: Build your budget with your team—not for them. Collaborate, test assumptions, and revisit the plan often.

How Forecasting Leads to Smarter Nonprofit Decisions

When you forecast regularly, you can confidently answer questions like:

- Can we afford to hire that new program manager next quarter?

- How big is our real fundraising gap?

- Will we need to tap reserves—and when?

- If revenue dips, what programs or expenses are at risk?

These aren’t just financial questions. They’re strategic decisions—and forecasting empowers you to make them with confidence.

Budgeting Is the Starting Point. Forecasting Is the Strategy.

If your nonprofit is still budgeting once a year and crossing its fingers, it’s time to level up.

Forecasting isn’t just good financial hygiene—it’s a strategic necessity. It transforms your leadership conversations, increases board confidence, and helps ensure your mission remains funded and focused.

Follow Us Online

Stay connected and get more exclusive content on:

- Website: www.thecharitycfo.com

- Instagram: @thecharitycfo

- Facebook: https://www.facebook.com/thecharitycfo

- LinkedIn: https://www.linkedin.com/company/the-charity-cfo-llc/posts/?feedView=all

- TikTok: @thecharitycfo

- Spotify: https://open.spotify.com/show/6hofQXPCxiPZuZy3OecW8y

- Apple Music: https://podcasts.apple.com/us/podcast/a-modern-nonprofit-podcast/id1542301310

Get Involved

Check Out These Blogs Next

What is Financial Forecasting and Why Does it Matter to Nonprofits?

Nonprofit Budgeting Best Practices

About The Charity CFO

We are an accounting partner that truly understands nonprofits. We know the missions that drive you, the obstacles that challenge you, and the dedication your job demands. We “get” nonprofits, because nonprofits are all that we do. If you need help with your accounting and bookkeeping, let’s talk.

Book a FREE consultation here!