Is this you? “I don’t know if my nonprofit’s accounting systems are bad… and I probably won’t know for sure until something bad happens.”

99% of nonprofit founders we work with don’t have a background in finance. If you struggle with feeling confident that your books are in order… and don’t know how to tell if they’re in order or not, this episode is for you.

This week on A Modern Nonprofit Podcast we discuss common red flags you can check today to verify your organization’s financial health.

In this episode, Isabel Sippo joins me to talk about the most common reasons why your nonprofit’s finances might be a mess, and ways to clean them up.

Isabel is the Onboarding Specialist at The Charity CFO. She focuses on helping new clients feel more confident about their financial records by re-engineering financial systems and minimizing opportunities for errors.

In this episode, you’ll discover…

- Key questions to ask if your books are out-of-date (5:50)

- 3 common issues that lead to messy, inconsistent books (10:56)

- The Big Red Flag you need to check for and how to fix it (15:28)

- How to get started so you minimize opportunities for errors (31:29)

Thanks for listening and be sure to subscribe for new episodes every week!

For more nonprofit accounting resources check out www.thecharitycfo.com.

🎧 Click here to listen to the Podcast on AnchorFM or Apple Podcasts

👇 Or scroll below to read the full transcript of our conversation

A Modern Nonprofit Podcast

Data Privacy Strategies for Modern Nonprofits

3/2/2022

Tosha Anderson:

Hey everyone. Welcome back to another episode of a modern nonprofit podcast. My name’s Tasha Anderson. I’m your host today? I brought along a special friend of mine, Isabel, not only, uh, do I consider you Isabel, a friend, but also a colleague of many, many years. And now more recently, one of my fellow coworkers, she actually works at the charity CFO now, and I’m super excited to have this conversation and I thought it was really cool to have you Isabel on because we have very similar, um, backgrounds, um, almost identical backgrounds, frankly. So Isabel you started your career. Um, actually even prior to public accounting, working on a couple different finance, finance, accounting, depart working for some pretty large organizations, um, both on the for-profit side, I think, and on the nonprofit side, but then you did a stint in public accounting and that’s where all of us accountants get a crash course and all things, accounting, um, across industries and myriad of problems that we come in contact with.

Tosha Anderson:

And that’s actually where I met. You used to audit nonprofit organizations back in the day, similar to me, but while I was the CFO of a nonprofit, you were my auditor. And when I left that organization, you actually took my spot. So really interesting stories. So you and I have both seen so many different nonprofits and we’ve both seen how quickly things it out of control, and we’ve both been responsible for cleaning up those messes. And now that you’re with the charity CFO, you are an onboarding specialist and your only job really is to help the newest clients in fixing their messes. And by messes, we mean, the books are just wrong. Um, they don’t know how to get them, right. Um, it could be just a failure to have any consistent processes, right? So how do I get this going and how do I get buy in from my team and how do I get it done consistently? Um, so that we can ensure we get through audits and then just kind of balancing all of those things together. So it Isabel, thanks for humoring me and coming on today and having conversations about your experience with messy accounting and how to get it fixed. Um, so again, thank you for, for taking time out of your busy schedule and chatting with me today about this.

Isabel Sippo:

Well thank you for having me and yeah, you’re absolutely right. I got to follow a lot of your footsteps. Um, some of your direct footsteps, which you left a great, uh, path for me. And then of course, as things evolve and companies change and get bigger and stuff, things change and yeah. Uh, you just have to learn to adapt.

Tosha Anderson:

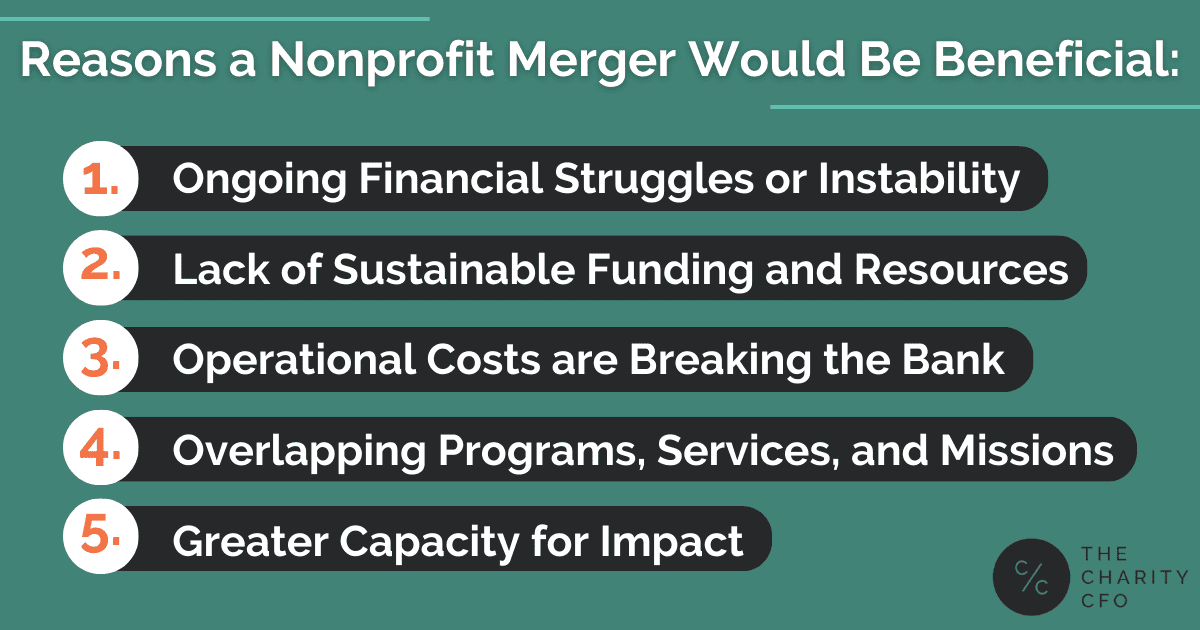

Yeah. That’s one thing for certain in the nonprofit world and you and I both worked for an organization that was growing very quickly because they went through a merger, but even without that, right, uh, different funding opportunities come up and those get compounded onto the existing accounting needs. It’s already there. And then of course, funders change their mind or the accounting rules have changed over the last few years for nonprofits. So there’s always something that requires some sort of re-engineering. And that I think is where a lot of organizations really struggle. A couple things actually, number one, that we’ve alluded to transition in leadership. So transitioning from one account to the other, whether it’s an outsource person, it’s a senior level person or even a bookkeeper. And frankly, I think the transition, the bookkeepers are even, um, more susceptible to error and where things get really, really messy for our clients.

Tosha Anderson:

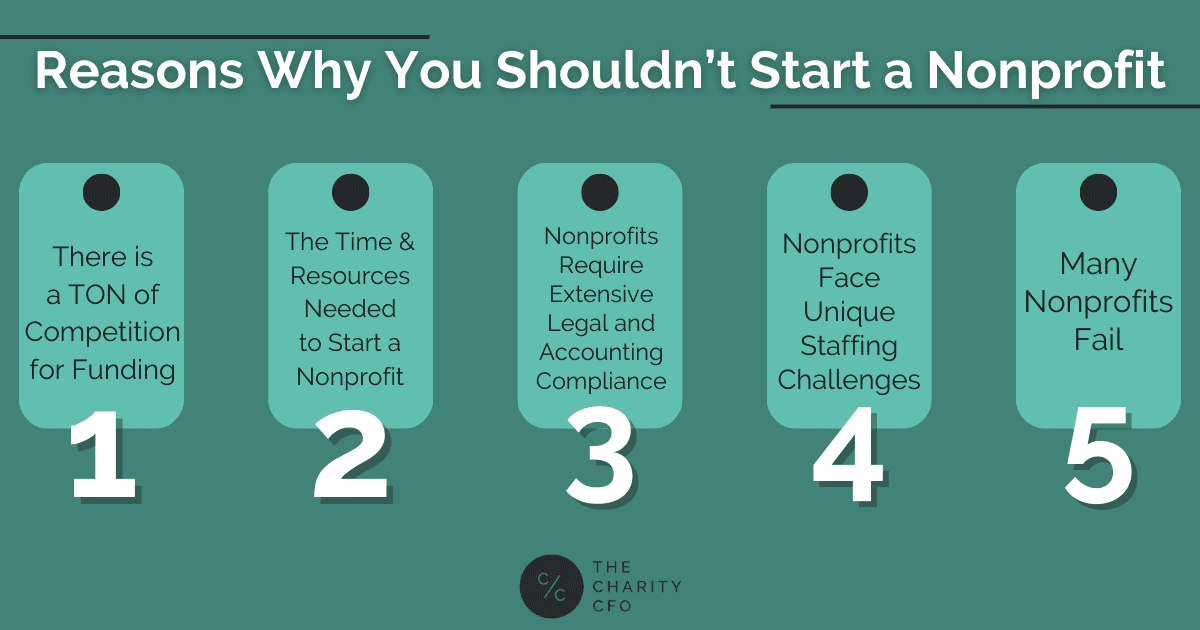

So that’s, that’s a common issue. And then also you have issues of size and complexity challenges, um, where you might have a person doing your accounting in place, but things have changed for one reason or another. And all of a sudden now that is beyond their skillset and we keep limping along and limping along, limping along, and then we keep adding more and more people because we think it’s a, uh, a band length issue. It’s a capacity issue. You, and really oftentimes it’s an understanding of the compliance needs issue, um, and a skillset, frankly, rather than, rather than a… a number of bodies issue. And so we’ve seen that happen a lot of times with organizations and before they know it fast forward, something happens. Um, it triggers in which they realize, wow, our accounting is not on track. And that’s what we’re gonna talk a little bit about today.

Tosha Anderson:

And I just wanna validate everybody. Um, I would say 99% of the people that I talk to that lead organizations, they do not come from a business background. They do not come from a finance background and their fear is always what they say to me. I don’t know what, I don’t know. I don’t know if my accounting is bad. I don’t know if my financial reports are inaccurate. I have some framework in which I might look at it and know, uh, that doesn’t seem totally right, but it’s not until something happens. And that’s something that happens is usually an auditor comes in, whether it’s your funder, whether it’s your financial statement, auditor, maybe it’s the tax return gets filed in correctly, or your board is just savvy enough to say, Hey, what’s going on here? And then you end up peeling, you know, the curtains a little bit and you realize, oh my gosh, this is an absolute disaster.

Tosha Anderson:

So we’re gonna talk about that. And for all of you that might suspect this may be happening. We’re gonna give you some tips on how to identify when that’s actually happening. So let’s just dive in Isabel with the first day. You look at a lot of accounting files all the time as part of your work here, certainly in your work, when you were a controller, a nonprofit organization, isn’t even prior to that, when you were an auditor, you’ve looked at a lot of accounting files. You’ve seen a lot of financial reports. What is the first few red flags that you see or that you go to when reviewing files, um, and those red flags or those points of referenced that helps you understand, okay, what is good or bad about this county system? What immediately speaks out to you? Like, Hey, we’ve got problems.

Isabel Sippo:

So I think, uh, the first place you always wanna look at is where they are in reconciling. Like, have they reconciled anything recently? Has it been years? If so, then you already know that you’re going into, um, get your, have to get your hands a little dirty to dig in and see, first of all, why they’re so behind and second of all, uh, what they need in order to be successful in reconciling. And then, um, the first place I always reconcile is if they’ve been audited, like let’s try and compare to the audited statements. Yeah. Why are they off? Why are they different? Usually it’s very simple. Um, after that, you just wanna go a little more in depth of looking at their outstanding accounts receivable. Why do we have outstanding accounts receivable? Are we billing timely? Are we expecting the money to come in? You know, where are we having hiccups in the road? Um, is there a cash flow issue? You could also determine that by looking at their accounts payable, like, why aren’t we paying bills? Are we nervous that we won’t have enough money in the bank? And, um, there are just a lot of different areas like that. You kind of want, uh, things clean. So how current they are is, uh, will help you determine if it’s a red flag or not. And comparing things to the audit is always the first step that I take.

Tosha Anderson:

Absolutely. And to reconcile that word is used, I think so regularly in the accounting world that it trips people up that are not accountants. So when I think of reconciling I’m with Isabel, I, I, first thing I do when somebody shares a file with me, when they’re like, oh, I wanna really share how far behind we are. Maybe a couple months. Like, just, why don’t you go ahead and send me your file. Uh, and the first thing I do is I look at the bank accounts, right? This is about like the cash. When is the last time they refiled their checking account, right? And if it’s been six months, eight months, 10 months, never, I’ve seen that before. Never. Um, then that tells you that what they’re, what that’s telling you is that what has hit the bank account, which is substantially almost everything that’s gonna show up in your accounting reports has never been actually double checked.

Tosha Anderson:

You’ve no one’s ever actually double checked that what’s hit. The bank account is actually been entered into the accounting system. And the opposite could happen are things that were hitting the bank account were omitted for in the accounting system. And then there’s also cases where things were put into the accounting system that never actually had the bank go and there could be duplicates and there could be omissions and there could be all sorts of things. And then the second type of reconciliation that we talk about, we talk about the balance sheet reconciliation. So basically you run a balance sheet report and essentially everything on that report should have, um, kind of an outside spreadsheet. You might be able to do it within the accounting system, but most accountants have an Excel spreadsheet. Now, Ismail, and I will say in practice, most accountants might only reconcile that once a year in practice.

Tosha Anderson:

Do You Struggle to Make Sense of Your Financial Statements?

Get our FREE GUIDE to nonprofit financial reports, featuring illustrations, annotations, and insights to help you better understand your organization’s finances.

Um, that’s not totally uncommon, but I would say best practice. What we like to do here is we do that every single month. So those are things of it Isabel’s referencing too. Are you when’s the last time somebody’s actually checked prepaids and here’s a here’s in my mind, a, a pretty sure sign that things are messy. Um, I look at when’s the last time the bank accounts have been reconciled and, and you should be able to find that in any accounting system, um, assuming that you’re not using like Excel, obviously Excel, wouldn’t be able to tell you that, but a QuickBooks or, you know, anything else that you’re using. The same thing I do is run the balance sheet report. And if you see any negative numbers on that balance sheet report, ask a lot of questions. If your accounts receivable is negative, if your accounts payable is negative, if there’s anything negative on there other than like accumulated depreciation, um, that’s a sure sign that something might be off and to Isabel coin.

Tosha Anderson:

The next thing I look at, you’re absolutely right. I look at accounts receivable. Um, and does that seem reasonable? You should know, as a leader of an organization, you generally owes me money and how frequently do people pay. So if you’re seeing, you know, funder, a, their balance is 120 days late, but, you know, fund a pays every single month, like clockwork, that’s a sure sign that things are off accounts payable, same way. If you’re noticing all of these positive and negative numbers on that report. And you’re showing that a lot of payments are over 90 days late, but you know, you have enough money and you’ve paid those bills. That’s another sure sign that things are off. So those are some pretty big red flags for me and Isabel when we inherit our clients. Um, and the good news is if you all have records like this, you are not alone.

Tosha Anderson:

You are not alone. Um, more often than not, this is common. Um, and unfortunately this happens, especially when you turn a over your accountants. And that is something that we see oftentimes in the nonprofit world, they’ll have a part-time person they’ll stick around, you know, for several months, a couple years, maybe then they change to another person and then they have to get up to speed. Um, and one thing about the county world as well, I don’t think people realize is much like any profession. There’s not always a black or white, right or wrong way of doing things is open to interpretation. And every accountant is going to have a different interpretation doesn’t necessarily mean it’s wrong. It’s just when you add all of these interpretations together, uh, you’re not in sync, you’re not in harmony. The, in the data of, within your accounting system could, um, not have a whole lot of it integrity. Right. So kinda keep that in mind. Okay. So now that we’ve looked at some of these accounting files and we’ve started seeing that doesn’t look right, what are some of the common issues you find when you take on some of our newest clients and look at their files? Like, what are the main things that are just wrong?

Isabel Sippo:

I, I think ultimately where all the issues stem from is the timeliness. So, um, many non-profit organizations, their finance department is always spread thin and helping every other department that they can, and then their finances always fall in the back burner. So, um, timeliness is usually the key of where all the issues are stemming from, like, why are the bank reconciliation not done on time? Why don’t have a finance report? Um, then when it does come to a deadline, they are scrambling to get things done. And there’s room for error there’s room for them not having the complete support time. I, you know, saved in the accounting system, saved in their files to reconcile to, and when people fall behind, they just keep falling behind. Yeah. And you have months of accounting work that doesn’t have any backup. Um, I feel like that’s where everything stems from.

Isabel Sippo:

There’s also the inconsistency of how things are recorded. So if people are picking things up and putting things down and then trying to fix it throughout the whole year, but they don’t have that standard. Like every month we’re gonna reconcile, you know, prepay aids and every month we’re gonna reconcile a bank. Um, it’s just hard to pick up and figure out where people left off, uh, during their cleanup also. Yeah. Some of the things that kind of piggybacking on what you said before is we have some bookkeepers that, um, you know, they were taught to do something one way and they never adapted, they have done the same journal entry every month for years, and it could be prepaids and we don’t have those expenses anymore, but we’re still allocating these random expenses and it’s, uh, they just don’t know when they should be adapting and when they should have changed and how they should look deeper into it, because they were told, this is how you do it. And sometimes They just need to have a process in reconciling and like looking at the back data to make sure that, uh, what they’re doing is actually what should be done

Tosha Anderson:

Well in, you said something that I think really, for me, boils down to the difference of doing accounting and bookkeeping. And what I tell people bookkeeping is getting the information into the accounting system. Accounting is to be able to look at those reports and know if that information was entered wrong, or the numbers are wrong and also understanding how to fix it. Right? Those are two totally different skill sets, um, is well, and I think so, oftentimes we see non-profits, they will hire bookkeepers that oftentimes have, uh, some sort of shared role. They do other things within the organization and you’re right. They just keep plugging along. This is the way we’ve always done it, da, da, but they don’t have somebody in house that can look at it and say, that is actually wrong. And here’s a pro tip. Um, and maybe I’ll get some hate mail from accountants out there later on.

Tosha Anderson:

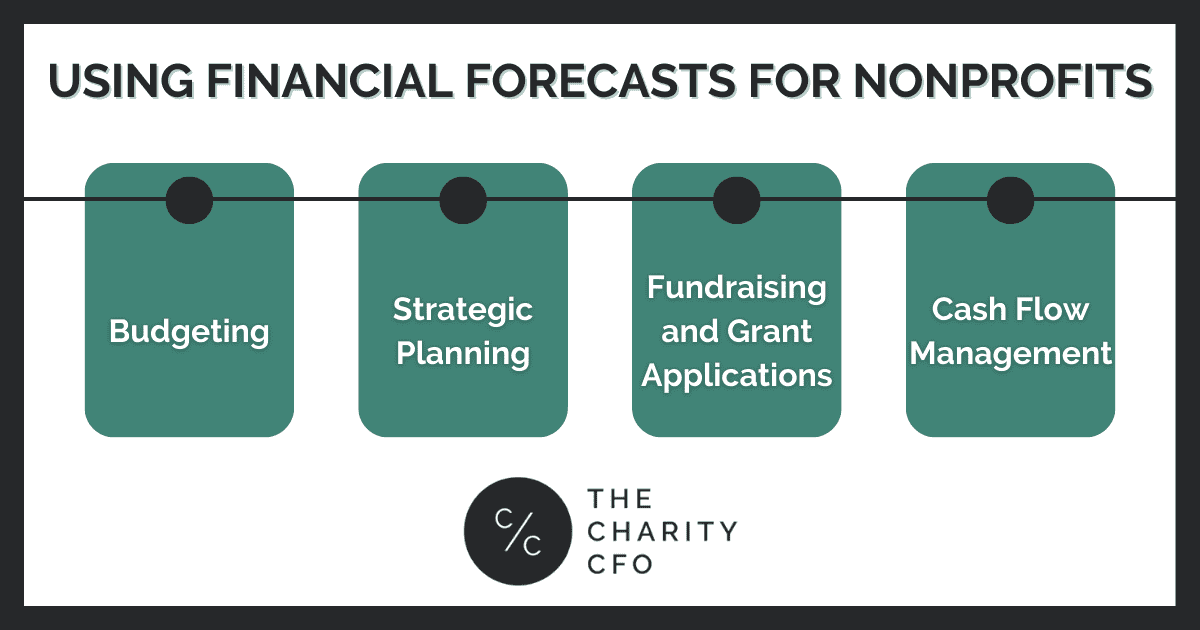

But the funny thing is running the financial reports in a modern accounting system does not take any time hardly at all. It’s all of the work that goes into your financial reports, even being ready to be, um, paired, right? It’s all those reconciliations we’re talking about. So if your accountant is not giving you financial reports, they are 100% not getting, um, those reconciliations done. Otherwise they can hit print and the reports spit out mostly. Um, now a few messages from accountants out there that say, well, I have to do all these manual reports in most cases. And in essentially in almost every case for our clients, it’s all of the reconciliations that take a little bit of time, which is why it’s so important to be doing those on a monthly basis. Because if you do them on a monthly basis, then you’re only looking at if this is off, we’re only looking at 30 days or, you know, a month’s worth of activity.

Tosha Anderson:

If you’re not doing those. And you finally, as Isabel said, you get behind, you get behind, you get behind and then like, shoot. Now I have to go back and reconcile three months worth. Well, yeah, that’s why you can’t get the reports out because you’re taking that much more time to go through 90 days worth of activity and figure out where do things go wrong as opposed to just 30 days. So if you’re not getting your reports, it’s likely because you’re not getting the reconciliations done. And if the reconciliations aren’t being done, that likely means that there’s some disputes between what your accounting system says is in the system and what, um, your bank account says and what the accounting rules say should be in the system. So there’s a disconnect there. So that should be a pretty red flag, a pretty big red flag.

Tosha Anderson:

If you’re not getting ongoing financial reports, that means something within your accounting function has gone off the rails. And that usually means that those reconciliations aren’t getting done, or the information’s not getting into the accounting system. We just onboarded a client, um, a few months ago. And this is a pretty large organization. I mean, I think there are budgets about 6 million a year for many of you out there hearing we, well, you know, I’m a small organization and I have all these problems that I’m alone because I don’t have more money. And if I had more money, I can hire accounting teams. We are here to debunk that myth, um, that larger organizations don’t have these problems, Isabel and I work with and talk with very large organizations, uh, you know, upwards of 10 million or more a year that have had this same problems that we’re describing.

Tosha Anderson:

So you are not alone. That’s the good news. Um, the bad news is we still gotta fix the problems at some point. So even really large organizations have this issue. And if you know that once those financial reports stop rolling in things have gone off the rails. And so if it’s a matter of, well, I just haven’t had time to, you know, get things done. Um, that’s a pretty big issue because when you fall behind, it’s gonna take a lot more time to get things up to speed. Okay. So those are some of the common issues that we find. Um, when starting to look at accounting files, we kind of alluded to it. AR is really off cap payables, really off cash balance could be really off. Um, we might have determined, um, some of the other things that I find kind of looking at AR and AP at the same time.

Tosha Anderson:

Um, once you get all that information to the system, you might notice, oh, shoot, I forgot to build this funder pretty big problem. Um, so we wanna make sure that cash never ends. And without seeing those reports on a monthly basis, you don’t see is revenue hitting every single funder as it should on the property. And lost statement are the statement of activities. If it’s not, that might mean that cash is not gonna continue flowing into the organization. So you need to be. And I pro tip too, just because it shows up on the financial report does not mean your accountant actually submitted the billing to the funder. That’s a whole separate process. Um, we’ve had that mistake happen for our clients. Okay.

Isabel Sippo:

And we’ve had situations where they just have to plug in an estimate because they’re waiting from the funder to come back with them with like a new temp, something. And then, you know, by the time it comes out,

Tosha Anderson:

They’re behind.

Isabel Sippo:

But we still have that number that was accrued on our statement.

Tosha Anderson:

Yeah. I would say for me, common issues could include easy fixes, um, payments like bills, payments might have been entered twice. Deposits might have been entered twice. Those are easy things cuz we didn’t actually deposit the check twice. We didn’t actually pay ’em better twice. It’s just duplication. So those are kind of easier issues, more call common issues that some of those balance sheet accounts prepaids accrued expenses. Those sort of things were never booked accordingly. Um, depreciation expense. Those are pretty easy. You can just go and tweak those. So those are kind of like more common issue, more serious issues. I would say that we often find that billing has not been submitted to the funder and, and or collected, um, on a timely basis. So that in impacts your cashflow other issues where we’ve seen, um, where we’ve identified that payroll taxes were not being remitted to the IRS.

Tosha Anderson:

Right? And so they’re finding that they have fallen behind on remitting. Now this should be done by your payroll company automatically, but for whatever reason, some organizations decide to try to do yourself pro tip strongly advised not to do that. But anyway, some do. And then you realize really big things like your IRA or your 401k deferrals were not remitted. Your taxes weren’t remitted, right? If you are not checking, what’s hitting the bank account versus what’s supposed to be hitting the bank account. That’s where you fall into issues with the IRS potentially department of labor. So those are bigger issues that are aren’t as common, but they still happen often enough that it makes my list. Um, but those are the kind of things that you look at. All right. So now that we’ve invoked all of the fear, um, into everyone Isabel and that these are the things you should, um, kind of be looking at. These are kind of the worst case scenarios. What is some advice you’d offer up to leaders of nonprofits to so that they can check and make sure that their accountants are doing a quality job. They’re doing the things that they need to be doing to keep the wheels turning within the organization. What advice might you give?

Isabel Sippo:

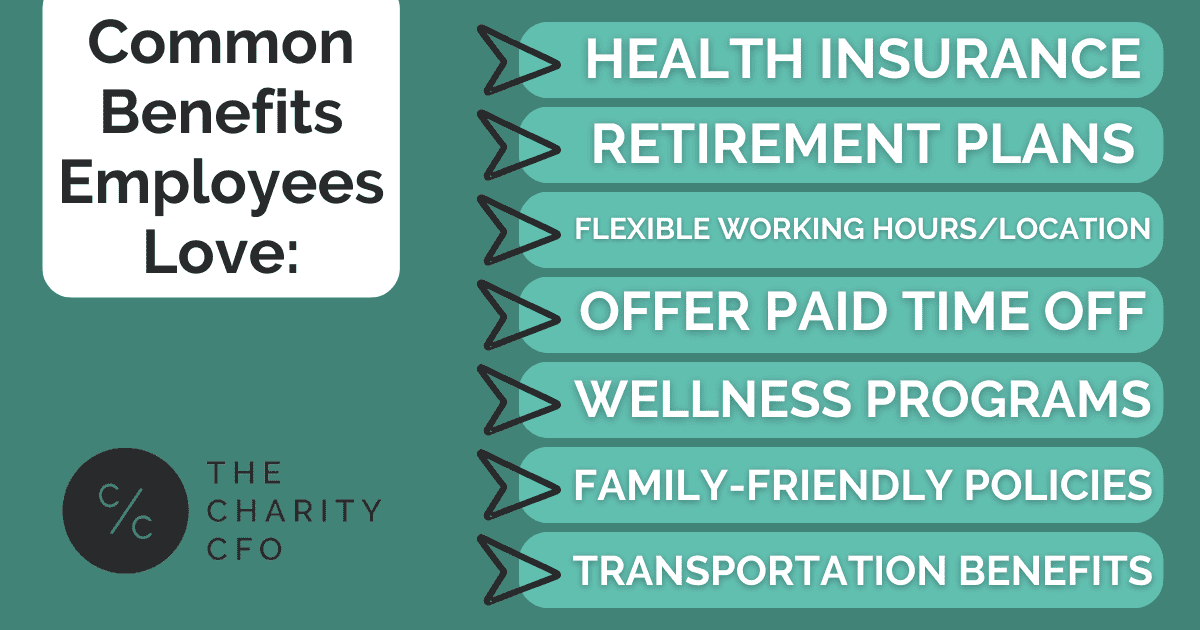

Um, the first advice I would give is to kind of get involved with the auditors. Don’t get involved in the like nitty gritty, all the paperwork and stuff, but at the end of the audit, when they’re going over adjusting journal entries and like all the changes that they had to make, make your executive team or your CEO part of that so that they can see like, Hey, these adjustments that they did, are we capable of doing it internally? Like why are they doing this? Get an understanding of, um, where the auditors are seeing changes should be made and see if we can, like you can update your department on how to right. Uh, do those processes. Um, another thing I would definitely say to leadership is with the time issue, um, if your finance department isn’t getting things to you timely, why not? I have worked in a non profit.

Isabel Sippo:

Tasha has worked in a non-for-profit there have been days where I was the only person after hours and then a toilet’s running and they’re like, oh my gosh, what do do we call, um, you know, rocks thrown through breaking windows. And we have to take inventory quickly on if any technology was stolen, getting an alarm that goes off that, you know, there’s a suspicious person in the lobby. That’s not making people feel safe. They encounter all this stuff. And then a lot of the times since finance is part of admin and um, so someone’s not answering fault phones. The first department they go to is, Hey finance, can you answer phones and direct phones? And the team takes on more than they can chew. Most of the time, a lot falls on finance. I know that doesn’t sound like the number one place where it happens, but all these little things add up and then don’t get done.

Isabel Sippo:

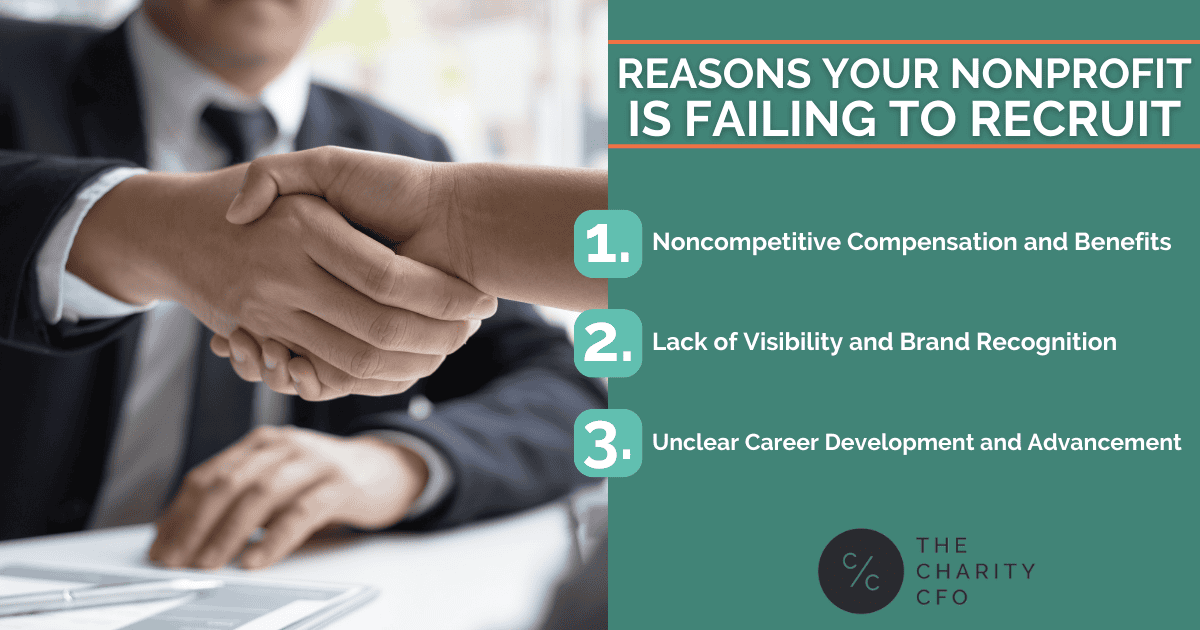

So I would suggest like leaders talk to your finance department, why aren’t things getting done? What have you done? That’s outside of your job description? You know what your job description is and, um, figure out a plan on how to prioritize their job. I always recommend to, um, cuz I have clients that are like, well this happened or I found out my bookkeeper was helping with plugging in donations and stuff. Right? I always say, Hey, tell your staff. If someone asks me to do something, you have to talk to my supervisor and get my supervisor’s permission for me to, uh, take this thing. That’s not typically my task. Of course everyone wants their department to be a team player. So nobody wants to not help out. But, um, that I feel like tends to be one of the biggest issues with the timeliness that, you know, finance is helping with grants, finances, helping with reports or funders or, you know, new rules was because of the pandemic that came out with payroll. Now everyone’s wondering to know like how these things change and uh, just have to provide support to the finance team to make sure that they can actually do their finance jobs and try to keep them on their narrow path.

Tosha Anderson:

Yes, yes. And I, I wanna do a whole nother episode on our podcast about this, but you bring up a really good point. One of the things that so you and I both obviously worked within a nonprofit and there was nothing exceptionally unusual about this organization and by way of being pulled in so many different directions, right? It happens all the time. This is not a judgment on, on this one particular organization. I’ve seen it time after time, after time, after time and every single person that I have worked with that have chosen to leave nonprofit organizations and anybody listening that works for an organization. I know you can, um, validate this and I know you can re relate to it that you’re pulled in so many different directions that you find that your primary responsibility, which, which in this particular case that we’re talking about is accounting and finance becomes a very small percentage of what you’re actually doing.

Tosha Anderson:

And I believe so strongly in this, that I was, you know, my background is accounting and finance and I was spending so little of my time doing that and being put in roles that I don’t have any experience and I don’t have any, um, specific skills in necessarily. And then you end up finding yourself in a place where you’re kind of just surviving in all of these different, you’re not thriving in any particular area. You’re not excelling in any particular area. And if you, you have a high performer, that’s in that role. And they feel like day after day after day after day, that they’re only surviving. This is where the burnout comes into play. And I feel so strongly about this, that whenever I actually left that organization, I was there for four years and, and I started this firm and I thought we’re only gonna do the thing that we’re best at. We’re gonna do accounting and finance for nonprofits. We only work with nonprofit. We only do accounting work. We don’t pretend to be HR experts. We’re not it experts. We’re not facility managers. We’re not, you know, we’re none of these things I’m not gonna, I’m not your program compliance person. I’m none of these things. I not make any

Isabel Sippo:

Client database or

Tosha Anderson:

Yes, yes. All of these things. And within our organization, I’ve realized, um, as a leader, you know, that I, this is a little bit off the rails from accounting and finance, but I really tried to figure out what is every single person on my team. And we have, um, over 30 team members now, what is their primary job, their primary job. We have to have a few Swiss army knives, right? For all of the things that you were describing, Isabel, you know, this happens and this happens, we do have a couple Swiss army knives, but as we keep growing, I keep, you know, identifying, okay, how can we pair this person’s responsibilities down? How can we pair this person’s responsibilities down so that they really have a primary job. And so to your point, Isabel, if your accountant has 10 other jobs, and then you’re wondering why, um, we can’t get the finance in order why we can’t get the accounting in order.

Tosha Anderson:

Oftentimes it’s because that primary job of them having accounting and financial management is often a very, very, very secondary role. I used to joke. I came in from seven to 9:00 AM to work on the accounting, which I’m a CPA, you know, that’s what they hired me for, you know, accounting background. And I spent the whole working day putting fires out for everything, but accounting and finance, frankly. Um, and then not unusual at all. And so I’m with you as well. If there’s things going on, it’s usually there are two, two different options in my mind. Um, it’s, they’re way above their head. They’re way they’re in way above their head from a technical accounting standpoint. And they just don’t know how to do the work. Or number two, they’re distracted with all these ancillary like responsibility is that they don’t have time to do the work.

Tosha Anderson:

Right. And so oftentimes what we’ll see is we’ll keep adding. We meaning the nonprofit organizations, we’ll just keep adding on more and more and more people within the accounting function. But the person that really understands the accounting and the process and all those things, they still don’t have the time or the responsibilities to, um, I should say they don’t have the time, the capacity to focus on those responsibilities to actually delegate those things, to, to train those things. So I think what was wise for this particular organization, when, when I had left, they started hiring more formalized positions. Okay, we’re gonna hire an HR function to do the HR stuff that we used to have the account do. We’re gonna hire, you know, a database person to work on the program database. We’re gonna hire maybe billion people to focus on. I’m making things up now.

Tosha Anderson:

Right. Um, but really kinda start carving out more of those responsibilities that aren’t really accounting in finance, uh, so that you’re accounting and finance people can really focus on just that. So anyway, that’s a little soapbox I can go on. And again, I wanna do a whole different episode on that, but back to, you know, really the meat potatoes of why we’re here now that we’ve identified the something’s going wrong in the accounting department. Um, whatever we figure it out, let’s say it’s, it’s one of those issues that I mentioned, which is more often than not the case is the, uh, the accounts are weighing over their head, they’re weighing over their head. Um, so oftentimes I know Isabel, you’ve seen this where you’ve inherited a set of books from somebody that might have had a banking background. They might have had a financial type background.

Tosha Anderson:

Uh, and I think us non-accountants, uh, well, if you understand finance and it’s it’s finance and accounting and how different can it be? And the reality is there’s two different types of accountants in my mind. Um, probably more than that, but there’s the day to day routine, very tedious, very reliable, get the information to the accounting system kind of person. Then there’s more like creative high level strategy, fix the world problems kind of person. Right? And oftentimes what I see as an organization will either hire 80% of the work is in the, get the, get the information to the system and get it done accurately and timely, right? That’s probably 80% of the work. So a non-profit will hire that 80% person. There’s a skillset gap between where we are at and where we want go is that 20% problem solving strategic leader type of person is not really within that wheelhouse or they’ll hire the 20% person. This is strategy person, but they have no idea how to actually do the day to day accounting, or they don’t have any desire to do the day to day accounting. Right. And they get burned out and then they end up leaving in a couple years, and then you’re by to the same situation you’re looking to higher again. So there’s

Isabel Sippo:

Philosopher with their head in the clouds. Like they have these grand plans, but like we need to get down in the nitty gritty and get it done. Yeah.

Tosha Anderson:

To get the work done. Yeah. Yeah. So then these organizations, right. Find themselves, you know, they either let go of the 80% person because they’re not quite what they need. Um, or the 20% person either gets, let go or ends up leaving because they’re falling further and further behind. Um, or the person just burn out the work, doesn’t be their soul. And by the way, they got an offer making more money, doing something else who knows, right. These sort of things. So then you’re left to, okay, now we’ve figured out we have this huge accounting problem. Um, it’s messy and we need to clean it up. And I have no idea where to start. I’m pretending to be a leader. You can tell I’ve had this conversation so many times, Tasha, I am not an accountant. I’m a program person. I’ve been in the program side for 17 years.

Tosha Anderson:

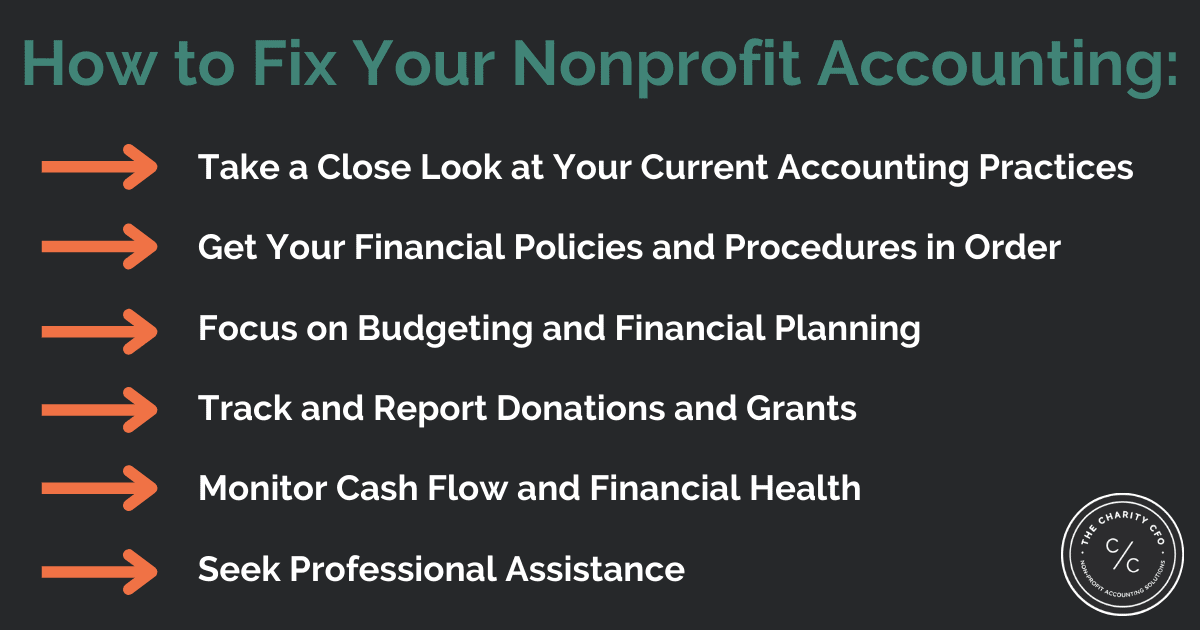

I stepped into this position as an interim CEO. We’ve changed CFOs two times in the last three years. I don’t know what the accounting should look like. I don’t know what condition the accounting is. And frankly, I don’t even know how to effectively interview an accountant to make sure I hire a person that does know how to do it. I don’t even know where to go from here, but all I know is my funders haven’t been billed in several months, we’re running outta cash. I have to turn the ship the right way. And I don’t know where to go. This is a true story. And so that’s where a lot of leaders struggle with. How do I even write the ship? Um, so I wanna talk a little bit about the cleanup, just how you, when, like what steps you should initially take and maybe what skills you should look at, or, you know, just some bumper bowling. I call it like some parameters, some boundaries for which, you know, that things are moving in the right direction. So let’s talk about that as about a little bit, where do you typically like to start? Or where would you advise someone to start when they’re dealing with, we know the accounting files an absolute disaster and this whole accounting function is a disaster we need to move forward.

Isabel Sippo:

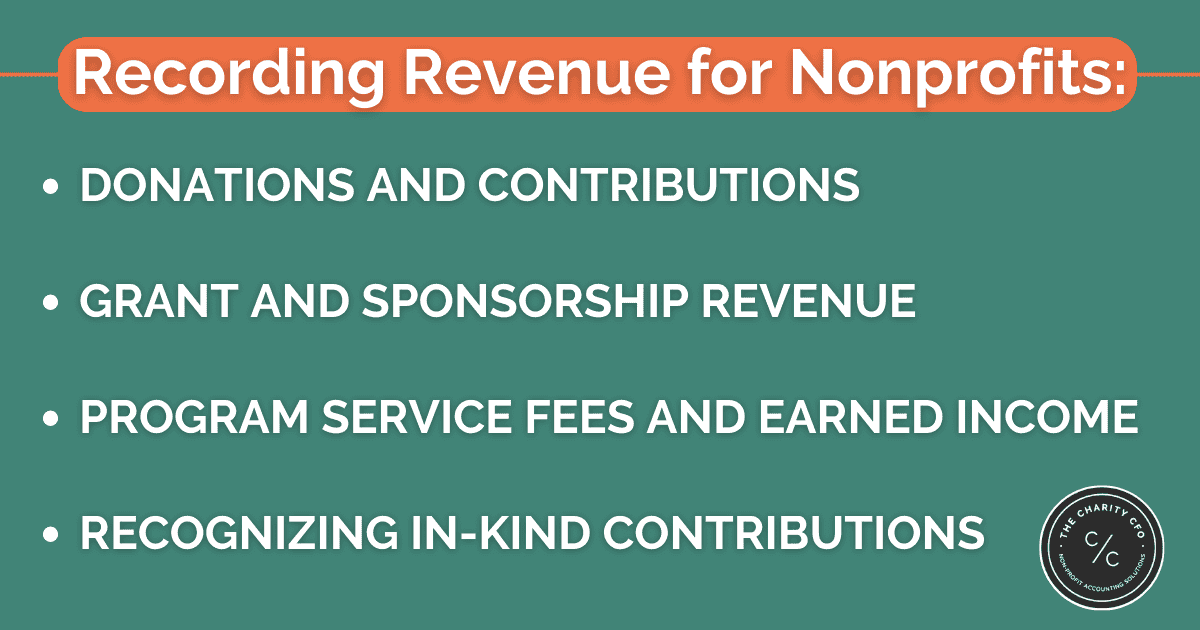

Um, I always say pick a point in time. It’s very easy when, uh, you have had an audit because you can start from the last audit that you’ve had, the auditors have done their work, they’ve done some due diligence. Like you have already financials that were presented out publicly. Um, it’s easy for them. You choose that last financial audit that you’ve had and you make sure that you reconcile, uh, the books to that. And then you have a starting point. Um, a lot of times nonprofits, uh, and you know, audit firms, aren’t bad guys. They want you to also succeed as well. So they will provide all these journal entry is that they just assume that they have to do every month. Um, so your books have never actually caught up internally. Uh, if you haven’t had an audit, that’s fine. Pick a point in time, do not pick 10 years ago.

Isabel Sippo:

You don’t need to be reconciling 10 years documentation start with last year, pick a date, re I, uh, and start reconciling from that point on, um, not only, uh, with tackling the accounts, they, they should be reconciling and cleaning things up and writing things off. It’s also a time for them to review the chart of accounts, their project codes, their T codes and stuff. If a lot of, I feel like a lot of nonprofits, a lot of account, you know, accounting systems in general, sometimes I think more is more and it’s not really like clean it up. Let’s hide things that have not been active in years. Let’s try to minimize any opportunities for errors, um, the value it, what you have. And then just, if things can be consolidated, we don’t need, you know, like supplies for the office and office supplies is a different, different account, you know, uh, try to make things as concise as possible, um, remove things that need to be removed because not only is it easier for you to do your day to day job, but then it’s easier and cleaner for board members, administration, donors, to be able to look at documentation and get a better understanding of what’s really going on.

Tosha Anderson:

Yeah. And I would add too, what we do for one of my favorite things that, that we do for, for our clients, when we go through onboarding, um, by onboarding, it usually includes cleanup, meaning, uh, we do a really intensive review, um, kind of an interview it’s usually takes an hour and a half, two hours. And we go through every single element of, of your accounting, more specifically, focusing on how money’s coming in and how money’s going out, right. The flow of funds. And we talk about those processes and we go down like, okay, let’s talk about all the different revenue sources. Let’s talk about all the different expense, you know, sources. How does expenses go out? Whether it’s through bill pays, um, through checks or credit cards or ACHs or whatever. Right. And then we talk about other things that are on the balance sheet.

Tosha Anderson:

So again, run that balance sheet report. If you don’t have a balance sheet report, pull out your last audit, pull out your last tax return, whichever and go through each one of those accounts. Okay. So if we have investments, do we know what makes up those investments? Do we know if there’s any strings tied to the investments? Like, ask all the questions. Okay. Prepaid expenses. Do we know what to have? That is, oh, that’s when we moved into our new office space and that’s a deposit. Okay, cool. To start understanding, like, what do these numbers stand for? And then take it a step further, especially on the billing on the money coming in and money going out. Do you understand what the processes are for every single one of those sources? Right. Um, and if you don’t, again, judgment zone, uh, you can blame the accountant, blame the transition and accountant or whatever, and have that conversation with your funders.

Tosha Anderson:

Hey, do you have a training guide? Do you have a funding manual? Um, I, you know, I can’t get, get passwords, like get passwords. So that’s always something that we talk about during our onboarding before we even completely dive in is just to make sure that business continues to operate and we will continue to populate the accounting database, but we understand the processes again, making sure money comes in, money goes out payroll, you know, how your employees are gonna get paid, any other key vendors that need to get paid, those sort of things. So definitely understanding what the process is. And then you can start getting that information into the accounting system as well. And then with Isabel. I love that. Go back to a point in time, which you believe very reasonably, that those numbers were accurate. If it was an audit that you have to assume is a hundred percent accurate because the auditors gave an opinion that it was accurate.

Tosha Anderson:

So you don’t wanna argue with that cuz you paid for that audit opinion. Now, if you don’t have an audit, go back to you, the last tax return that was prepared, um, for which, um, you know, somebody preferably hopefully, um, some sort of CPA has reviewed your files, felt confident enough in the numbers that they’d be willing to swap their name across the bottom of that tax return. So start with those numbers and then we call that kind of rolling forward. So as Isabel was saying, say your last tax return for was for December, 2020. Okay. Now you know that you have a whole year’s worth of activity. So then you’re gonna get all that information from your da your bank. Um, and then you’re gonna get that into your account sort, start categorizing it. And then you’re gonna start going through again, that process documentation of the institutional know, gathering of, do I know what all these sources of revenue are?

Tosha Anderson:

Do I know what all these expenses are, start populating that. And then what we do is go month by month and reconcile the bank statements, we’ve at least accounted for everything that hit the bank account, everything that hit the bank account. Now the categorization might need to be updated. That’s shown into office supplies instead of profession development or whatever. We know that all the money that came in and all the money that went out within the bank account ended up in our accounting system. So that’s usually where we start with things too. Um, okay. So coming up, running up out of time, Isabel, I wanna wrap this up. Any other advice that you might offer leaders of organizations inside or outside of the accounting function, right? Um, maybe how they can handle their accounting and financial management better. Um, I know we talked a little bit more about just having open and honest conversation with your finance folks about all the things that they’re dealing with, but anything else beyond that, that you might wanna share?

Isabel Sippo:

Yeah, I think, um, a great place to start, trying to make an improvement is to, uh, meet with your team regularly, meet with them first week, create a checklist. Was everyone responsible for have the checklist as detailed as possible. If you know that payroll can be in by the third of the month, make sure that’s the deadline. This also allows for, when you do meet with them monthly, you can talk to your team of specifically, Hey, you haven’t met these deadlines yet. Why not? And I don’t like to go talk to people, very judgmental, making assumption, you know, approach it positively. There’s positively logical reasons why. Yeah. Um, there’s been a delay and if there, it also allows you opportunity of if they are falling behind how you can approach them to say, what can I do to help you in order for us to meet our deadlines?

Isabel Sippo:

Um, yeah, be a little proactive. Uh, not only making checklists, you know, don’t reinvent the wheel, let’s work on trying to make templates. I feel like, especially from personal experience, you know, you create a uniform way to build all these different funders and stuff, try to create a template that’s kind of universal. Um, sometimes it, you kind of like lose your footing because suddenly all these funders want different information, uh, that you need to, uh, supply to them. So in those moments, take a few extra minutes and see if there’s an easier way that you could take add more into the monthly reporting that you’re doing so that you can kind of make it consistent across the board instead of constantly making a different, unique, um, process for every single step. Whenever for the most part, you could try to keep things as consistent as possible. Absolutely. Um, and in order to kind of improve timeliness, you know, create templates, create recurring entries, um, like I said, Uh, formatting of running reports that have all the information that you need. And then also evaluating like if development is needing certain kind of reports a certain way, is there a way for us to also build that kind of template in our system? Just so you’re, department’s not spending an hour manipulating data that you have every single time they need something. Yeah. Let’s try to think how we can use things, uh, more than once, uh, moving forward.

Tosha Anderson:

Love that. Speaking of that was gonna be my advice a little bit on the month end reports. I remember when I used to work at a nonprofit organization every single month, I would actually print the reports and I would sit down with the CEO and I would walk through every report every single month. And it was a good exercise, um, because I was then forced to be prepared to present the key findings and takeaways. And it forced her to sit down with me and understand and ask, follow up questions. And I will say now that I’m a leader of an organization, I really struggle with doing all of the things that I need to do to effectively manage the company. Um, there’s just so many things and so many people to be accountable for. So what I have found that works best for me is having systems of accountability for myself.

Tosha Anderson:

So I assign all these tasks to my team members that really sound like maybe I’m keeping, um, them accountable. It’s really a process that helps me keep myself accountable. So if I know that I’m asking for a report for each one of my team members so that we can go over it, I, in a meeting, they think they’re being accountable and oh, well I have to show Tasha what I’m doing every month. No, actually it’s so that when I sit down on that report or sit down at that meeting, I have all these reports and I’m forced to then sit down and walk through them. And then I ask all the appropriate questions. And because we have this recurring meeting set up every single month, I know that I’m gonna have to force myself to be prepared for that meeting. And I’m gonna look at these things.

Tosha Anderson:

So as, or this business has continued to grow and grow and grow and grow. Um, and I’m, you know, running around like, you know, uh, just a, a maniac, right? Um, and it’s not unique to nonprofits. It’s unique to any sort of entrepreneur leader of any business that you’re pulled in a million different directions. So have that system of accountability, I’ve talked to so many leaders of organizations that say they wish they understood their finances more. And I think the easiest way to get an understanding is set that recurring meeting with your accountant, have that person actually print that report. Don’t email it to you and expect you to review it on your own time. Is that gonna happen? At least initially when you develop the, have it’s sitting down actually with a paper, um, report if necessary, um, and pour over those numbers, understand those numbers, um, and ask questions, uh, and not just look at it from compared to last year, maybe compared to last month, why did cash go down this past month?

Tosha Anderson:

Oh, well, because this funder was late paying us or whatever. Um, so sit down and ask those questions. That would be our advice to you. But anyway, Isabel, we are running out of time. So I wanna say thank you again for joining us and having this conversation. I know it’s painful for a lot of people to even think about or talk about their skeletons and their financial closet, but, uh, we’re here to help if you all need any assistance or help go to our website, thecharitycfo.com, Isabel, and I will be happy to chat with you, about what that might look like for us to help you, or at least offer some, pointers in the right direction on how to handle that. So stay tuned for the next episode. Thanks again. Bye everyone.