7 Keys to Nonprofit Financial Management

Nonprofit financial management is one of the primary concerns for organizations.

Nonprofits are special types of organizations, in both their structure and their purpose. They live in the hearts of many as symbols of good in the world. This meaning is the driving force behind what nonprofit organizations do day in and day out.

However, in the midst of all the support for nonprofits, it may be lost that nonprofits are still organizations that need to be run. The mission can only live on to serve its purpose by having backing from a successfully managed organization. This is why at The Charity CFO, we strive to provide relevant resources and support to ensure that your organization runs smoothly and efficiently. This week, we’ve rounded up 7 keys to nonprofit financial management. If you’d like to dive deeper into any of the topics, we’ve included relevant links to further your knowledge.

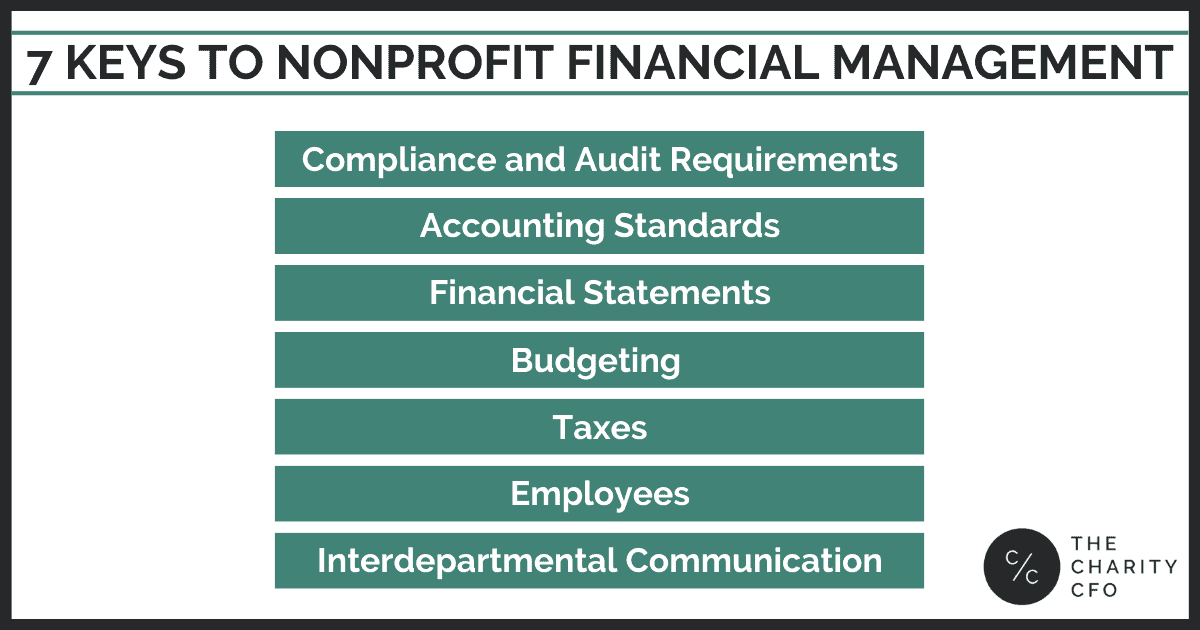

In order to successfully manage the financial health of your nonprofit organization, here are 7 key concepts you should understand:

Compliance and Audit Requirements

Compliance is the act of ensuring the public that nonprofits are abiding by the rules that allow them to take advantage of tax exempt status and other financial incentives. Compliance requirements vary by state and funding sources. Confirming an organization’s compliance can include compliance checks and/or audit requirements, but maintaining compliance is the responsibility of the organization at all times.

Accounting Standards

In the United States, all organizations must adhere to the Generally Accepted Accounting Principles (GAAP). For nonprofits, however, there is an additional and specific set of standards that organizations must follow, as set out by the FASB 117. This establishes core accounting standards for nonprofits which help with accountability and transparency. It is important that nonprofits understand the accounting standards they are required to adhere to and how these standards differ from for profit accounting.

Financial Statements

Knowing what goes into and how to properly compile financial statements will greatly support the ability to make decisions, comply with regulations and audits, and provide insights and transparency to donors and supporters. Nonprofit financial statement requirements are a bit different than for profit. They include:

- Statement of Activities

- Statement of Financial Position

- Statement of Cash Flows

- Statement of Functional Expenses

Understanding an organization’s financials is like unlocking a door to the health of an organization, and can help track progress and goals over time.

Budgeting

Nothing says healthy financial management quite like a robust and well-thought out budget process. Creating, tracking, and adjusting a budget throughout the year can be the difference between achieving organizational goals or falling short. Budgets also support your efforts to complete the above requirements, like maintaining compliance and preparing financial statements. Intentional budgeting can empower employees, inform executives, and drive critical change. While it may seem time-consuming and overwhelming, it’s always worth the effort and you will continue to reap the benefits.

Taxes

Yes, taxes. Even though nonprofits are regarded as tax-exempt organizations, it is still incredibly important for nonprofit leaders to have an understanding of what this status means and the requirements behind it. Understanding what tax and reporting requirements your organization may have is critical to maintaining that tax exempt status. While 501 organizations are tax-exempt, it does not mean they do not have to file taxes. Requirements may vary depending on the type of 501 organizational category you fall into:

- 501(c)(3): Charitable, Religious, or Educational Organizations

- 501(c)(4): Community social welfare organizations

- 501(c)(6): Business leagues, professional associations, real estate boards, and board-of-trade organizations.

It’s imperative to stay on top of your tax filing and reporting in line with your organizational status.

Employees

While employees might not seem directly related to successful nonprofit financial management, they can have a huge unintended impact. When understanding how employees affect your financial health, consider:

- Organizational chart – ensuring that you have the right people in the right positions can make an organization run smoothly. Utilize your employees’ skill sets and expertise to your advantage. This is especially true for your finance team, but also applies to teams with indirect impact on the finances of the organization, such as the fundraising, donor, or grant teams.

- Filing and Forms – whether an organization finds themselves able to hire full time employees or relies on contractors, the filing requirements are important to understand. The types of people and the work they do for your nonprofit will determine whether you need to complete a W2 or 1099 come tax season.

- Payroll Expense – In many organizations, nonprofit and for profit alike, salaries and payments to contractors make up the largest expense. Therefore, it tracks that you will want to understand the structure and the employees that make your organization run and take a look at how these expenses are falling.

Interdepartmental Communication

The final key to successful nonprofit management is to understand your organization as a whole. Open communication can provide you with insights that might otherwise be missed. These can help drive the budget process, financial goals, and strategic decisions. Functions such as marketing or fundraising can show you where money is being spent, the expected results, and how they plan to implement changes to boost donations.

They can also provide details of change drivers that the finance team may be unaware of. Keeping the lines of communication open across the organization and allowing for transparency, feedback, and support may be the most important key here. This also extends beyond the organization. Having a holistic view, open communication, and an open mind might be the key that unlocks the door to successful and efficient financial management.

Partner for Streamlined Nonprofit Financial Management

Overall, there are many aspects that make an organization tick, and the financial management function is the engine driving it all. Taking the time to holistically look at your finances, understand the meaning behind them, make realistic adjustments, and maintain compliance can make all the difference in the success and longevity of your organization.

The Charity CFO specializes in helping nonprofits simplify their finances so they can be confident. Reach out to us here for a free consultation.

No time to read this article now? Download it for later.