Independent audit requirements for a nonprofit

The word audit can invoke instant fear and dread. Whether it’s an IRS audit, external audit, or even an internal audit, the process can feel burdensome and worrying. However, with the right tools and preparedness, there’s no need to worry.

Contrary to popular belief, most audits are not conducted to detect a problem. They are actually useful tools to ensure that an organization is in compliance and can also be used to identify potential problems before they become too big.

The IRS does not require nonprofit audits in most cases, however, they may periodically request an audit (examination) or a compliance check.

Should My Nonprofit Obtain an Independent Audit?

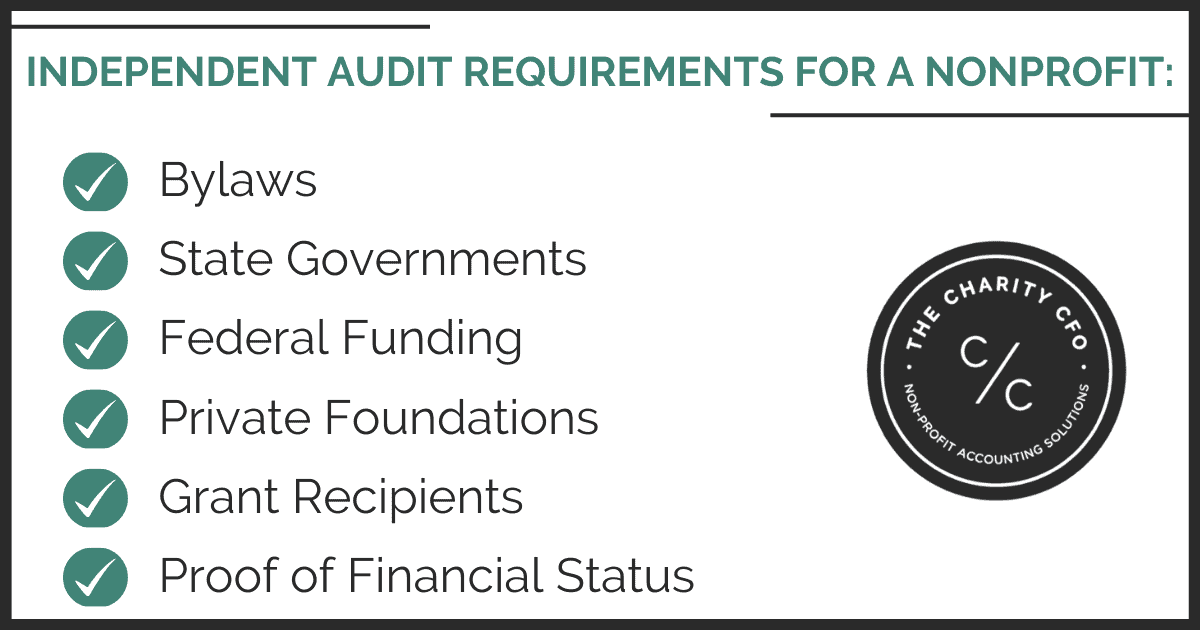

If the IRS doesn’t require an audit, you may wonder why you might put your organization through this process, as cumbersome and time consuming as it can be. However, there are a few reasons why you might need to conduct an independent audit to remain in compliance with your organization’s other obligations.

- Bylaws: The bylaws of your organization may have been outlined to require regular audits to ensure transparency, security and confidence in the financial standing of the organization.

- State Governments: Depending on the state you operate in and the funding you receive, you may be required to conduct an independent audit.

- Federal Funding: If your organization receives $750,000 or more in federal funding, you are required to have an independent audit conducted.

- Private Foundations: Some may require nonprofits to conduct an independent audit

- Grant Recipients: If your nonprofit has received funding from grants, some may require audits to ensure that they can have confidence in the financial aspects of the organization that they have provided this money to.

- Proof of Financial Status: Additionally, other funding sources or applications might require proof of financial management, solvency, transparency and compliance. While they may not specifically state that an audit is required, this is a great way to fulfill that obligation.

Selecting an Audit Firm

Once your organization has decided to obtain an independent audit, the real work begins. Taking steps to make sure that you are working with the right audit Firm is important. Do your research and select Firms that specialize in nonprofits.

- Outline your requirements – be detailed about what you are looking for from an external audit firm.

- Send out RFPs – select three to five Firms that you believe could conduct the audit properly and send them an RFI/RFP to determine their qualifications, approach, and fee structure.

- Interview potential Firms – give your organization and your accounting team the opportunity to interact with the potential auditors to determine if they are a good fit.

- Make your selection – select the Firm that you believe can fulfill your specific audit requirements and are aligned with your goals to provide accurate, transparent, and clean financial statements.

- Sign an engagement letter. This should include:

- An outline of services to be performed

- Responsibilities of staff and auditors

- Fee Structure

- Start date, milestones, and end-dates

How to Prepare for an Audit

In the nonprofit world, audits are a normal course of business and should not be something to be nervous about. With appropriate planning, they can go smoothly. As soon as you know that you will be obtaining an independent audit, begin the planning process.

- Conduct pre-audit meetings with the auditor, the oversight committee, and any staff that will be involved in and responsible for items requested throughout the audit.

- Receive a listing from the Firm of documentation that they will require

- Pull and obtain the documentation before the start of the audit to the best of your abilities to avoid delays and confusion.

- Have staff readily available to answer questions and provide clarification to auditors.

- Stay ready year round and with an audit checklist and roadmap.

After the audit, make the appropriate adjustments and continue to keep up with the suggestions that are made.

Implementing and making changes to your processes and internal controls after an audit can help make future audits even more successful and ease the stresses that these can cause. These changes can also provide the following benefits.

- Transparency: Communications regarding your audit and the changes that are being made can boost confidence and assurances in your donors and supporters. They can feel good knowing that you are properly taking care of and using their contributions appropriately.

- Accountability: Regularly scheduled audits keep your organization accountable for consistent accurate reporting

- Improvements: Finding opportunities for improvement in policies and procedures is an added benefit to audits that can result in additional efficiencies and better usage of resources.

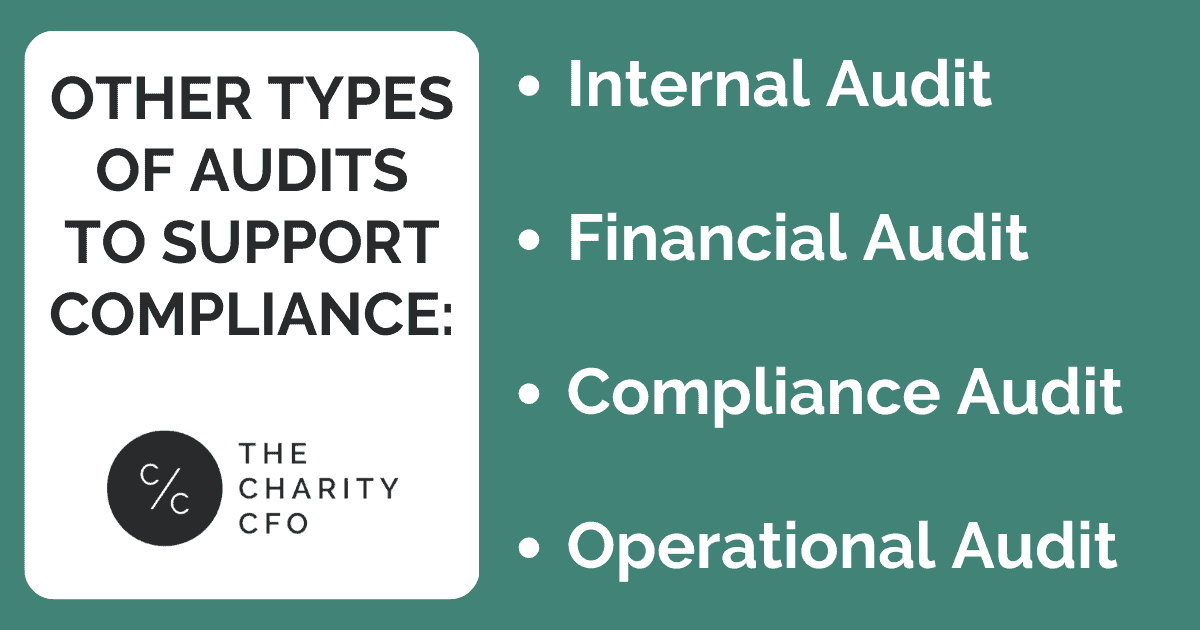

Other Types of Audits to Support Compliance

While the independent external audit is the most familiar to nonprofit organizations, the following can also support your compliance efforts.

Internal Audit

These are conducted by staff within your organization and can help identify opportunities for improvement in many different areas. Internal audits allow organizations to remove themselves from everyday tasks and take a look at the big picture to more effectively and efficiently manage their operations and achieve their mission.

Financial Audit

Financial audits are useful in evaluating your organization’s financial statements and reporting. They can help understand and showcase the health of your organization and work to improve it. These can also examine your internal controls to ensure financial security and stability.

Compliance Audit

Compliance audits are conducted to review adherence to regulations and requirements set by your bylaws, the federal, state, and local governments, as well as other compliance requirements. Ensuring that you remain in compliance is an important task, as noncompliance can have huge risks.

Operational Audit

These can assess your organization’s systems, productivity, staffing, IT, HR, and other functions and can provide operational insights that are invaluable to the growth and success of your nonprofit.

Whether or not an audit is required, they can be useful tools in determining the financial health of your organization, providing transparency and assurances, and discovering process and efficiency improvements to make sure your organization is performing its best to fulfill its mission. If you need audit support, The Charity CFO and its experts are always available.