Why Your Church Shouldn’t Take Pass-Through Gifts

Churches often want to help those in need, especially among their congregation. But if you’re not careful, you could be accepting pass-through gifts that could cost the entity’s 501(c)(3) tax-exempt status.

Pass-through gifts are donations given with the expectation that they will be used to benefit a specific individual or organization.

These types of gifts can come from individuals or organizations and often are made with the intent to support a specific person or group. This type of gift is not tax deductible for the original donor and it does not count as a charitable donation to the church.

When pass-through gifts come into play, churches often have little control over the funds and how they are used. That’s why it’s important for religious organizations to make sure they understand what these donations mean and that they don’t accept them without proper safeguards in place.

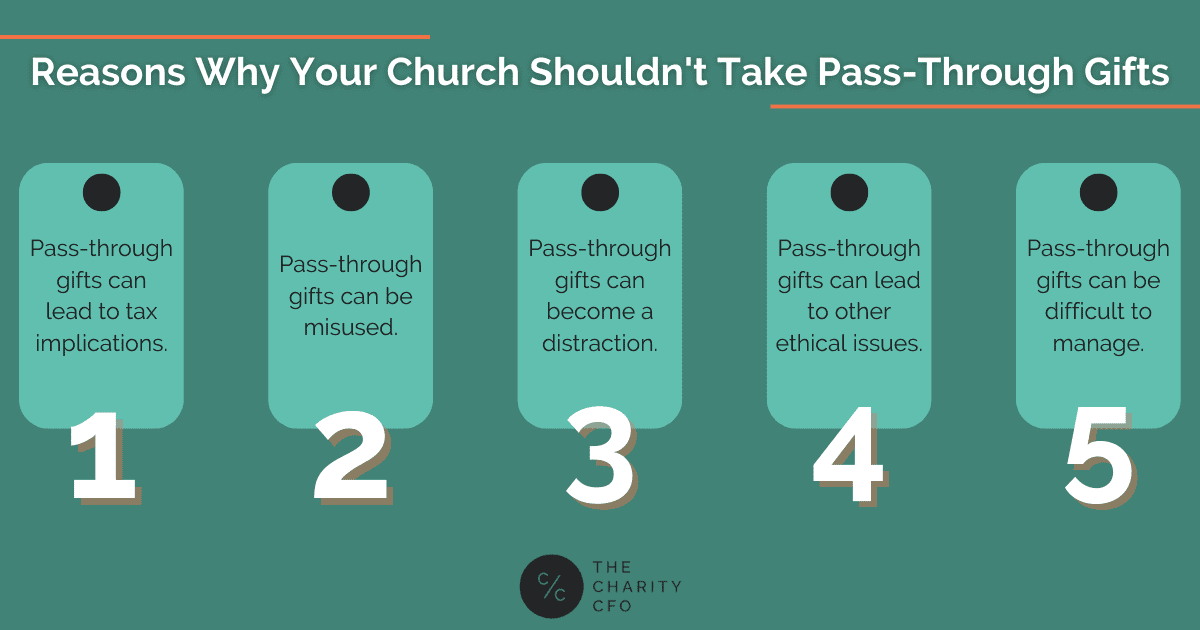

Let’s look at a few reasons why your church should step back from pass-through gifts.

Reasons Why Your Church Shouldn’t Take Pass-Through Gifts

1. Pass-through gifts can lead to tax implications.

Pass-through gifts are one of the most common ways for churches to lose their 501(c)(3) exemption. The IRS is always looking for any signs of non-conforming activity, and pass-through gifts are a red flag.

The reason? By giving funds to an individual or organization directly, the church is essentially sidestepping the normal process of applying for and receiving 501(c)(3) status. This can lead to serious repercussions, including the revocation of the church’s tax-exempt status and hefty fines.

2. Pass-through gifts can be misused.

Even if pass-through gifts are given with the best of intentions, there’s no guarantee that the funds will be used properly. If a church accepts a pass-through gift, they are essentially handing over the funds without any control or oversight.

This can open up the possibility of misappropriation and open the church up to legal liability. Donors can sue if they feel that their gift has not been used as intended.

3. Pass-through gifts can become a distraction.

When pass-through gifts are accepted, it can create a disconnect between the church and its mission. Instead of focusing on their core values and purpose, churches can be pulled into a situation in which they are responsible for funds that should be managed by others.

This can lead to a decrease in the overall effectiveness of the church and a lack of focus on its core mission.

4. Pass-through gifts can lead to other ethical issues.

Churches that accept pass-through gifts can also find themselves enveloped in ethical dilemmas. For example, if the funds are given to help a certain individual, what happens if the funds are not used as intended?

This can lead to debates over how and when to use the funds, let alone questions about transparency. These ethical considerations can be difficult to navigate and often create a divided church.

5. Pass-through gifts can be difficult to manage.

Pass-through gifts can require a lot of oversight, paperwork, and tracking to ensure the funds are used properly. This can be an overwhelming task for churches that don’t have the staff or resources needed to handle it.

Even if your church does have the resources to manage pass-through gifts, there’s no guarantee that the money will be used as intended. Without proper oversight and controls, donors may not be assured that their funds are being used for their intended purpose.

Case in Point Example

John and Mary are congregants at your church. Their house was razed in a fire, and they had nowhere to turn. In response, you ask other members of your church to donate so that John and Mary can rebuild a new home.

You advise the members to donate to the church’s benevolence fund but with explicit instructions: all donations will be given to John and Mary, and so the checks should be made out directly to them and not the church.

Unfortunately, the donations made out to John and Mary are considered pass-through gifts, which the IRS will tax. This means that John and Mary will have to claim the donations as taxable income when filing taxes.

So what should you do next? Well, while your intentions were good, it is important to know that taking pass-through gifts can be a costly mistake for your church and John and Mary as well.

Instead, you should consider setting up a special fund to help those in need.

Creating a special fund

By creating a special fund and collecting donations into it, your church can provide tangible help to those in need without worrying about tax implications. This is because donations made into the special fund are not considered pass-through gifts, so the donations are tax-exempt.

Additionally, setting up a special fund can help your church gain recognition from the IRS. As long as the money collected is used solely for charitable purposes, your church will be eligible to receive tax exemptions on all donations made to the fund.

By setting up a special fund, you are able to meet the needs of those in need while protecting your church from tax liabilities.

A gift is considered charitable if it’s:

- A donation or contribution to, or for the use of a church

- Made “without any condition or restriction

- Claimed as a charitable deduction on the donor’s tax return

- Within the limits specified by the IRS

- Substantiated by a receipt or other reliable written record

Certainly, taking pass-through gifts can be tempting. After all, what could be easier than having congregants make donations directly to those in need? But when it comes to tax liability, the risks outweigh the rewards. Setting up a special fund is the best way for your church to help those in need without having to worry about pass-through gifting.

By providing a safe and tax-exempt way for congregants to provide charitable donations, your church can ensure that the money goes towards helping those in need without any tax liability.

Protect Your Tax Exempt Status with The Charity CFO

Churches and other nonprofits are subject to strict state and federal tax laws. As a church, understanding the rules can help you protect your tax-exempt status while helping those in need.

At The Charity CFO, we understand that your church’s tax-exempt status is important to you. We can help you navigate the complexities of tax law on pass-through gifts and provide you with the necessary guidance to ensure that your church is compliant and protected.

With our team of experienced and knowledgeable tax professionals, you can feel confident that your church’s status as a nonprofit is secure. We are committed to helping your church maximize its charitable impact and stay compliant with state and federal tax laws.

Don’t let pass-through gifts put your church at risk. Contact The Charity CFO today and let us help you find the right solution for your church. We look forward to helping you protect your tax-exempt status and reach more people in need.